1. Introduction

The development of artificial intelligence (AI) has advanced financial technology (fintech) by integrating finance with AI. Recently, this integration has extended to property technology (proptech), combining properties with AI. This field of property technology is also experiencing significant expansion. In Japan, there have been various attempts to apply AI to the real estate business, including support for brokerage and management, internet of things (IoT) application, crowdfunding, vendor matching, and property valuation [

1]. The attempt to apply AI to the property valuation is particularly noteworthy because the issue of “information asymmetry” between sellers and buyers has long been considered a significant problem in the real estate business [

2]. If property valuation using AI (AI property valuation) achieves practical application, it is expected to enhance the efficiency of the valuation process and improve labor productivity across the entire real estate industry in addition to solving the issue of “information asymmetry”. Labor productivity in the Japanese real estate sector was notably low by international standards, at just 28.4% of the productivity observed in the United States [

3]. Given the anticipated population decline and aging demographics in Japan, the effective utilization of AI is an urgent issue for the real estate industry, which is concerned about a potential labor shortage.

Currently, more than 20 AI property valuation services are available in Japan. The AI property valuation services are popular among users seeking to buy or sell their properties due to their easy availability. However, the algorithms used by these services are either undisclosed or only partially disclosed, leaving their valuation mechanisms unknown to users. Furthermore, since property transaction prices are not publicly available in Japan, research on the accuracy of AI property valuation is limited to insiders or special organizations with access to the prices. There is no standardized or publicly disclosed data used for training AI. As a result, variations in the AI property valuations among the different services may arise due to differences in algorithms and data, but the actual extent of the variations has not yet been clarified. Despite these limitations, research on AI property valuation is ongoing. The users as general consumers, who are not real estate professionals, do not have access to the actual transaction price information and cannot assess the validity of the valuation. They do not know to what extent they can trust the AI property valuation services or how to interpret the variations in the valuations among the services. When the AI property valuation services are used, the extent of the variations should be considered.

There are various studies on variations in property valuations without AI, as discussed below. The studies reported that the range of the variations was 5–10%, with approximately 5% being the level expected by end users. It is important to investigate and demonstrate the extent of variations in existing AI property valuation services compared with expectations. It is also important to examine the factors that influence the valuation, as there are many reports that valuations were influenced by client pressure, which lead to the variations. The AI property valuations do not seem to be influenced by clients because they are conducted by AI. However, the AI property valuation services also have users, so they may be subject to some bias from the users. Therefore, this study focuses on the users and considers the business model of the AI property valuation services with how the service providers earn revenues through user interactions.

This study aims to understand how users currently perceive AI property valuation by providing information on the extent of variations and the potential bias of the business models behind these services. In this study, AI property valuations were collected from five AI property valuation services for existing condominium units in six popular residential areas in Tokyo, namely Aoyama, Akasaka, Azabu, Kichijoji, Meguro, and Ikebukuro in. (1) The percentage variations from the means of the valuations by each service, the standard deviations and the differences between the minimums and maximums of the valuations among the five services are calculated after statistically significant variations in the AI property valuation services are examined. Comparing the variations in the AI property valuations with those in the traditional property valuations, this study clarifies the extent of variations in the AI property valuations. (2) In addition to the extent of the variations, the factors for these variations are examined with the business models of the AI property valuation service providers. This study analyzes business characteristics, including how the AI property valuation services are used and how revenues are ultimately earned through these services, considering the business models of each service across two groups: high and low valuation groups. Through these two analyses, this study clarifies the current state of the AI property valuation as much as possible.

2. Literature Review

2.1. Property Valuation Models

Hedonic pricing models have been used for property valuation, especially for the estimation of existing housing prices, and there have been many studies on this topic, mainly in the United States [

4,

5,

6]. In Asia, studies have been conducted on housing in various cities such as Singapore, Seoul, Hong Kong, and Bangkok [

7,

8,

9,

10]. For improvements of the valuations, an Artificial Neural Network (ANN) was used, and the models with an ANN fitted better than traditional multiple regression analysis [

11]. In the other study, Support Vector Machine (SVM) regression as a machine learning approach was compared with the traditional Ordinary Least Squares (OLS) linear regression [

12]. For the valuations as apartment selling prices, it was also shown that an ANN can better predict the prices and provide stability [

13]. ANNs were also applied to predict commercial property prices and real estate auction prices, as well as housing prices [

14,

15]. In addition to an ANN, fuzzy logic was also reported to be suitable for property valuation [

16,

17]. Furthermore, research on the valuations for residential properties using adaptive neuro-fuzzy inference systems was reported, compared with those obtained using a traditional multiple regression model [

18]. There have been many studies on the potential of AI for property valuations, and there have been various attempts to develop algorithms for this purpose. For example, tree-based ML algorithms and a Bayesian neural network were proposed [

19,

20]. In addition, four Automated Valuation Models (AVMs) based on machine learning and deep learning were compared, and the eXtreme Gradient Boosting (XGBoost) method outperformed other algorithms such as Support Vector Regression (SVR), random forest, and Deep Neural Network (DNN) [

21].

Many attempts have been made to improve the accuracy of AI property valuations. The performances of ANNs with linear, semi-log, and log-log models were compared, and the results demonstrated the semi-log model as the most preferred technique [

22]. Incorporating time series-based clustering as a supplementary parameter through transfer learning, using a variational autoencoder (VAE) for properties with lower market transaction volume, and adding precise geographical location features to the machine learning algorithm inputs by geocoding were reported to improve valuation accuracies [

23,

24,

25]. Recently, the emerging role of Large Language Models (LLMs) like ChatGPT as an AI was also scrutinized in property valuation [

26].

For many of these reports, a systematic literature review of the mass appraisal model of real estate from 2000 to 2018 highlighted a 3I trend, namely the AI-based model, the GIS-based model, and the MIX-based model [

27]. In the past five years, from 2019 to the end of 2023, research findings confirmed a clear trend towards increased utilization of artificial intelligence techniques, especially machine learning [

28].

While the development of AI property valuation has been reported, one study on a comparison of three different AI-based housing price estimations with traditional multiple regression analysis reported that traditional multiple regression analysis was superior [

29]. This indicated that AI was not necessarily superior. In addition, a critical review of the studies that adopted an ANN for property valuation reported that most of the studies were conducted by university scholars, while very few industry practitioners participated in the research [

30]. A questionnaire survey was conducted to elicit information from valuers practicing in Australia. The results showed that traditional methods were the most adopted methods by the valuers, while advanced valuation methods are seldom applied in practice [

31]. Abidoye et al. reported that all property valuation stakeholders should invest efforts in promoting the adoption of AI valuation methods in practice to bridge the gap between theory and practice. This will help reposition the property valuation profession [

32]. Źróbek et al. also reported that modern valuers should acquire skills related to innovative valuation techniques and decision support systems [

33]. The transition of the property valuation profession in the digital age with AI-based models is under discussion. However, as many AI property valuation services already exist, research on these services is needed.

2.2. Literature in Japan

In Japan, the pricing and sale of existing homes have been discussed in terms of the process of such transactions, the retained interests of the seller, buyer, and intermediary entities, the transaction prices, and the optimal offer prices [

34,

35]. In the factor analyses for the property valuations, the hedonic models of the condominium unit prices in the Tokyo metropolitan area were reported [

36,

37]. AI property valuation attempted to estimate condominium unit prices using an ANN, suggesting its potential for practical use in Japan as well [

38]. Evaluations on validation data with the multiple modeling using the AI reported that the model with light GBM had the highest coefficient of determination [

39]. It was also reported that adding human pre-specified rules improved the model [

40]. While these studies showed the potential of AI property valuation, it was pointed out that an ANN can miss predictions to a greater extent than a regression analysis [

41]. In addition to such algorithm-related discussions of AI property valuation, there were also differences in the training data for AI, as the training data not only used the transaction prices but also the offer prices [

42]. There have been various studies on AI property valuation in Japan as well, indicating that there may be differences in the current AI property valuations.

2.3. Variation in Property Valuations and Factors Influencing the Valuations

It is generally known that there are some variations in property valuations. Their levels have been reported to be important in court cases, such as negligence in valuations [

43,

44]. Most of the research on variations in valuations among valuers has been for commercial properties. Hager and Lord reported that the average overall variations from the means of the valuations for offices and retail shops among valuers were approximately 5% plus or minus, and then Adair et al. found that the average overall variation among valuers was 9.53% and the standard deviation was 8.55% with larger samples [

45,

46]. The reported cases for residential properties were few, but the variances in the valuations of the residential properties in South Australia were discussed in an unpublished work by Daniels (1984). For the basic residential valuation, the average absolute error was 5.3% with a standard deviation of 2.3%. The end users of the valuations saw an error margin of plus or minus 10% as acceptable in most cases, but for basic residential properties they would expect errors to be within 5% plus or minus. This error range would be the largest accepted error, not the average [

47]. While research has reported variations in traditional property valuations among valuers, the variation in AI property valuations has not been reported to date. Therefore, comparing the variations between traditional property valuations and AI property valuations in this study is crucial for discussing AI property valuation. This study aims to clarify the extent of variations in AI property valuations among various service providers and to demonstrate these variations to users, which is important.

It is also important to consider the factors that contribute to the variations in property valuations among valuers. Mohammad reported that there are six (6) elements of a valuer’s behavioral uncertainties, which include heuristics and bias, ethical conduct, client influence, the valuer’s experience and knowledge, the availability and accuracy of market data, as well as negligence and professionalism [

48]. Among them, there are various studies on client influence. In particular, client feedback related to mortgages has been reported to influence valuations [

49,

50,

51]. It is also reported that clients with expertise and a high level of knowledge of the property market are able to influence valuers by way of expertise and information power [

52]. AI property valuations do not seem to be influenced by clients because they are performed by AI. However, AI property valuation services also have users, so they may be subject to some bias from the users as well as client influence on traditional property valuation. Therefore, this study emphasizes the importance of focusing on the business model of the AI property valuation services and how service providers earn revenues through user interactions instead of client influence on traditional property valuation.

3. Materials and Methods

3.1. Materials

In this study, the research was conducted from October to December 2022 for five AI property valuation services in Japan: IESHIL, Price Map, Condominium Navigator, Speed AI Condominium Valuation, and Condominium AI Automatic Valuation, which list a large number of properties and whose valuations can be easily obtained from their websites. From among more than 20 AI property valuation services in Japan, services were selected in this study based on the user’s perspective as services that do not require personal information, are available free of charge, and provide detailed property information such as distance from the station, building age, total number of units, floor number, and exclusive unit area. These services provide valuations of single condominium units. According to the 2023 Housing and Land Survey conducted by the Ministry of Internal Affairs and Communications in Japan, housing complexes, which generally means condominiums or apartments in Japan, accounted for 72%, while detached houses accounted for 26% in Tokyo. This indicates that housing complexes are more common than detached houses in Tokyo. Therefore, AI property valuation services primarily target condominium units.

Since the target properties for this service are condominium units, the research focused on the popular residential areas and specifically targeted six areas: Aoyama, the Akasaka, and Azabu areas, known as the “3A” areas, which are popular residential areas with high-end condominiums, and the Kichijoji, Meguro, and Ikebukuro areas, which are often ranked highly in “Most livable area” surveys [

53]. These areas were selected because popular residential areas generally have a large number of properties for sale, allowing for a larger sample size. Additionally, a large number of properties for sale typically means that the transaction prices within each area are relatively stable. The samples were properties for which data were manually collected from all five services on the same day for each individual condominium unit. We actually used each service to collect the data as users. Each service is online, and property information and AI property valuations are automatically displayed when a condominium name, station, or address is entered. Therefore, the same data can be collected by anyone, but the data collection for this study was conducted by one person. Among the five services, the properties that matched the apartment name, floor number, and exclusive unit area were used for the comparisons. As a result, the total number of properties was 859 in the six areas. In total, 4295 property valuations were sampled, corresponding to the number of services providing the valuation data for each property. It took approximately three months to collect this sample size.

Table 1 presents the means of the basic property information on the samples in each area.

The means of the AI property valuations (in million JPY) for each area indicated that Aoyama, Akasaka, and Azabu—recognized as high-end condominium areas—were roughly twice as expensive as Kichijoji and Ikebukuro. According to

Table 1, the mean of the distance from the station in most areas ranged from 6 to 8 min, with the Akasaka area slightly closer at 4 min. The mean of the building age ranged from 24 to 30 years, the total number of units was approximately 60 to 80, and the floor number ranged from 5 to 7, showing no significant differences among the areas. The mean of the exclusive unit area was typically 60–80 square meters, except in Ikebukuro where it was smaller compared to the other areas. In the statical difference tests in this analysis, the property valuation was not divided by the exclusive area in order to take the user’s perspective into account.

Table 2 shows the basic statistics on the AI property valuations in each service.

The means of the AI property valuations (in million JPY) were in the 70 million JPY range for IESHIL and Price Map, while they were in the 90 million JPY range for Condominium Navigator, Speed AI Condominium Valuation, and Condominium AI Automatic Valuation. The standard deviations were in the 60 million JPY range for IESHIL and Price Map, but in the 80–90 million JPY range for Condominium Navigator, Speed AI Condominium Valuation, and Condominium AI Automatic Valuation, suggesting that there might be differences among the services. The differences in the means and the standard deviations indicated that the five AI valuation services were classified into two groups: Condominium Navigator, Speed AI Condominium Valuation, and Condominium AI Automatic Valuation as Group 1 (high valuation group), and IESHIL and Price Map as Group 2 (low valuation group).

3.2. Methods

This study examines the statistical differences in the AI property valuations for each service, the extent of the variations, and the factors for the variations. As preparations for the analyses, the Shapiro–Wilk test was conducted on the valuation distributions of each service to confirm normality [

54]. The result showed that the

p-values of all five services were below the 1% significance level, indicating that normality was not confirmed. In this study, multiple comparison tests on the valuations of the five services were conducted. However, since the test method varied depending on the equal variances, the Levene test was conducted on the valuations of the five services [

55]. The result showed that the

p-value was below the 1% significance level, indicating that the five services were not considered to have equal variances among them. Therefore, the statistical tests for differences were conducted without assuming a normal distribution and equal variance. Based on the results of the Shapiro–Wilk test and the Levene test, the Friedman test was conducted to confirm the differences in the AI property valuations among the five services as the paired samples [

56]. The

p-value was below the 1% significance level, indicating that there was a significant difference in the mean ranks of the AI property valuations among the five services.

Since the significant difference was confirmed in the mean ranks among the five services, we tested differences in the valuation of each service individually and confirmed the groups indicated as Group 1 (high valuation group) and Group 2 (low valuation group) in the previous section. Therefore, the Steel–Dwass test was conducted as a multiple comparison (

Table 3) [

57,

58].

Group 1 (high valuation group) included Condominium Navigator, Speed AI Condominium Valuation, and Condominium AI Automatic Valuation, and the

p-values were among them above 5% significance level. Group 2 (low valuation group) included IESHIL and Price Map, and the

p-value was between them above 5% significance level. Therefore, it was found that there was no combination of the services with statistically significant differences within each group. In addition, The Brunner–Munzel test was conducted for the differences between the two groups (

Table 4) [

59].

Table 4 showed that the

p-value was below the 1% significance level, suggesting that there was a difference in the mean ranks of the two groups. Therefore, the five AI valuation services can be classified into these two groups.

After these preparations, the first step is to examine the extent of the variations in the five AI valuation services. In this study, the variations are calculated as the percentage variations from the means of the valuations by each service in the same way as existing studies. For each property, we check how far each service is from the mean of the five services, and the variations are visually shown by a scatter plot. We also calculate the standard deviations and the differences between the minimums and maximums of the valuations among the five services. By comparing these results with the variations in the traditional property valuations without AI in the existing studies, the characteristics of the variations in the AI property valuations are clarified.

Next, for the two groups of the services classified in this section, we identify their characteristics by comparing the business models of each service and examining the variation in valuations of the two groups. Then, we discuss the potential impact of the business models on the AI property valuations, based on the variation and characteristics observed between the two groups.

4. Results

4.1. Extent of Variations in the AI Property Valuations among the Services

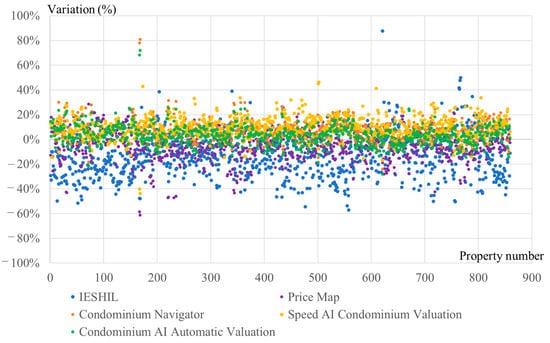

The percentage variations from the means of the valuations by each service were calculated for each property. A scatter plot of the variations in the AI property valuations by each service for each property is shown in

Figure 1.

Figure 1 indicates that Condominium Navigator, Speed AI Condominium Valuation, and Condominium AI Automatic Valuation in Group 1 (high valuation group) were mostly above 0, while IESHIL and Price Map in Group 2 (low valuation group) tended to be below 0.

The averages of the percentage variations from the means of the valuations were calculated for each property. A scatter plot of the average variations is shown in

Figure 2.

Figure 2 shows the variations on the vertical axis and the valuations (million yen) on the horizontal axis. The variations in the valuations of less than 50 million yen are mostly within 20%. For properties with valuations of over 100 million yen, the number of properties with variations of less than 10% was small, and the variations were spread upward. This confirms the tendency for the variations to be larger for properties with larger valuations.

The numbers of variations and differences in the AI property valuations among the five services within each range are shown in

Table 5. The differences are between the minimums and maximums of the valuations among the five services.

The average overall variation from the means of the AI property valuations among the five services was 10.6% with a standard deviation of 12.6%. Compared to the traditional property valuations, it was larger than the average overall variation of 9.53% for offices and retail shops reported by Adair et al. and the 5.3% variation for basic residential properties reported by Daniels. Only 53% of all valuations was within the variation range of 10%, and it was smaller than those of the existing studies of Adair et al. and Daniels. In addition, the average difference between the minimums and maximums of the valuations among the five services was 34.4%. Compared to the traditional property valuation, it was significantly larger than the 8.64% difference between two valuers for retail, office and industrial properties reported by Crosby et al. [

60].

These results indicate that the variations and differences in the AI property valuations are larger than those of the traditional property valuations and exceed the 5–10% margin expected by the end users in the existing studies.

4.2. Consideration of Variation Factors for the AI Property Valuations

In the valuations of the same properties conducted by AI, statistically significant variations among the AI property valuation service providers were confirmed. The factors for these variations should be considered. It is natural for property valuations, including the traditional method, to vary to some extent, and it would be rare for the property valuations to be exactly the same. While the AI property valuation services offer easy availability, it is assumed that users (buyers or sellers of units) may use them without understanding the variations due to the artificial nature of the service.

This study aims to examine the factors contributing to these variations, focusing on the business models of the AI property valuation service providers. The service providers are engaged in the business of providing information. Although the AI property valuation services are generally offered free of charge, the providers should be earning revenues by linking the said services to their businesses. Therefore, we examined the business characteristics of each service, such as how they utilize the AI property valuation services and how they ultimately earn revenues through the services. These findings are organized into

Figure 3.

In Group 1, where the valuation was higher, Condominium Navigator was considered a “sale introduction type” business that earned revenue from the number of sales consultations directed to its affiliated brokers through the AI property valuation service. Speed AI Condominium Valuation and Condominium AI Automatic Valuation were provided by the brokers and were considered “in-house sale type” businesses. These services directly led to property sales and earned brokerage fees. In these business models, only brokerage fees were paid to the AI property valuation service providers, which could lead to biases toward higher valuations. The interview with a brokerage firm confirmed that the business practice of obtaining quotes from several brokers and selecting the broker with the highest valuation was still in place in Japan. In addition, the brokerage fee was proportional to the transaction price in the real estate brokerage industry. This practice suggests a bias toward higher valuations.

On the other hand, in Group 2, where the valuation was lower, Price Map primarily operates as a property search website and was categorized as a “website search type” business, earning revenue mainly from its search service. The AI property valuation service was considered an added value to differentiate itself as a property search website. IESHIL was considered to be an “advisor type” business that had a person in charge called an “IESHIL Advisor” who consulted with clients and introduced them to various companies, in addition to placing advertisements on its website and earning advertising revenue. These business models were user-oriented services, and they operated by earning the revenues from non-brokerage fees such as responses to their property websites and advertisements. Therefore, it was important how many prospective buyers and sellers of properties use their websites. As a result, biases for higher valuations were unlikely to arise because the valuations would be fair or slightly lower for prospective buyers. From the above consideration, group 1 with the higher valuation had a bias to raise the property valuation as a “sales inducement group” that encourages their sales. On the other hand, group 2 with the lower valuation might not have a bias to raise the property valuation as a “user attracting group” whose purpose was to attract users.

To further analyze the valuations, the samples were divided into quartiles based on their mean values between the two groups, and the standard deviation and coefficient of variation in the differences between the two groups were calculated (

Table 6).

The coefficients of variations were larger in the higher valuation quartile, as shown in

Table 6. In the general valuation ranges from the first to the third quartile, which were not the high valuation range, the coefficients of variations ranged from 0.13 to 0.17.

Considering the significant difference in the valuations between the two groups of service providers, we cannot rule out the possibility that AI property valuation is dependent on the business model of its service provider. If this is the case, it would be misleading for users to view AI property valuation as an accurate, transparent, and fair valuation. The AI property valuations do not seem to be influenced by clients because they are conducted by AI, although traditional property valuations have been reported to have client influence. However, the AI property valuation services may also have some bias from the users as well as client influence on traditional property valuation. AI property valuation is an important tool and should continue to be developed to enhance labor productivity in the real estate industry. However, the existence of valuation variations due to the business models of the service providers may hinder its healthy development. Since users expect accuracy and transparency in AI property valuation, they should not expect to see significant variations in valuations due to the differences in their business models. If this situation becomes common, it could lead to a loss of confidence in AI property valuation. One important implication of this study is to highlight the concern about the current state of AI property valuation.

5. Conclusions

In this study, 859 properties (condominium units) were selected in the six popular residential areas of Aoyama, Akasaka, Azabu, Kichijoji, Meguro, and Ikebukuro in Tokyo, and a total of 4295 valuations were analyzed for variations in five AI property valuation services. Our analyses provided the following two results.

(1) The variations were calculated as the percentage variations from the means of the valuations by each service in the same way as in existing studies. The standard deviations and the differences between the minimums and maximums of the valuations among the five services were also calculated. The average overall variation from the means of the AI property valuations among the five services was 10.6% with a standard deviation of 12.6%. The average difference between the minimums and maximums of the valuations among the five services was 34.4%. These results indicated that the variations and differences in AI property valuations were larger than those in traditional property valuations and exceeded the 5–10% margin expected by the end users in the existing studies. In addition, the tendency for the variations to be larger for properties with larger valuations was confirmed.

(2) Since statistically significant variations in the AI property valuation services were confirmed, the factors for these variations were examined with the business models of the AI property valuation service providers. We examined the business characteristics of each service, such as how they utilize the AI property valuation services and how they ultimately earn revenues through the services. Considering the business models of each service across two groups: the high and low valuation groups of the service providers, the high valuation group (Group 1) was considered to be a “sale inducement group” with a bias toward raising the AI property valuations. On the other hand, the low valuation group (Group 2) might not have a bias to raise the AI property valuations as a “user-attracting group” whose purpose was to attract users. The significant difference in the AI property valuations between the two groups indicated that the AI property valuation depended on the business model of the service provider. Therefore, the results meant that users should be aware that AI property valuation might not always be accurate, transparent, or fair. The variation in AI property valuations could be influenced not only by the business models but also by other factors, such as property size, as larger valuations tended to have larger variations. Conducting a quantitative analysis of these variation factors remains a topic for future research.

Real estate is a highly individualized (non-homogeneous, non-substitutable) asset, and it is generally believed that the valuations differ from one real estate broker or appraiser to another. Therefore, it can be expected that AI property valuations also differ depending on the algorithm, training data, and business model of each service provider. However, the algorithms of the AI property valuation services are not disclosed, making it difficult to understand the actual calculation process of the valuation. In this study, we conducted analyses to provide an indication of the extent of variation among the services from the viewpoint of the user’s perspective. On the other hand, it is appropriate to evaluate the services, including the algorithms and data used by each company. It is hoped that the service providers will disclose their algorithms and the data they use, as this will enable sound AI property valuation. Currently, AI regulations are being developed, as the European Council approved a ground-breaking law aiming to harmonize rules on artificial intelligence, known as the Artificial Intelligence Act, in May 2024. Given the observed variations in the AI property valuations and the factors contributing to the variations in this study, it is necessary to promote the healthy development of the AI property valuation by establishing guidelines, such as requiring the AI property valuation services to ensure a fair price or disclosing their algorithms and data.

Finally, we list an issue. This study examined AI property valuation externally from the viewpoint of the user’s perspective through publicly available information. However, since the actual transaction prices are not publicly available in Japan, it is impossible to analyze how these valuations relate to transaction prices, even though the variations and characteristics of each service can be discussed. We believe that if information on the transaction prices was available, it would be possible to conduct an analysis that includes their estimation errors. Research on estimation errors is essential for advancing AI property valuation to the practical use level. For this analysis, we requested Real Estate Information Network for East Japan to provide actual transaction price data. However, we were unable to obtain the data because providing data for research at a university is not recognized as an official purpose (confirmed on 7 June 2023). To this end, we strongly expect that the academia will be able to widely access information such as the actual transaction prices (contract prices) and sales histories of each property in Japan. The development of AI in the real estate industry signals that we are entering an era in which the industry can grow even more by sharing transaction information rather than keeping it secret.