1. Introduction

However, these studies are primarily limited to analyzing the literature associated with the broad term “green finance” and do not extend bibliometric analysis into related subfields, such as green financing, green FinTech, green building, and green derivatives. Furthermore, these reviews lack a systematic examination of the various subfields, application areas, and intersections within green finance, and they do not fully explore the role of policy frameworks and emerging fields like green FinTech.

This paper aims to systematically summarize existing research on green finance from a broad perspective that encompasses its various subfields and explores their intersections through both bibliometric and qualitative analyses. Unlike prior studies, this review not only encompasses a broader time frame but also integrates emerging subfields such as green FinTech and the role of policy frameworks in advancing green finance. We meticulously reviewed a substantial body of the literature on green finance, employing a methodological approach that facilitates a comprehensive synthesis of recent studies. This enabled an examination of predominant research themes and emerging trends within the green finance domain. Building on these research trajectories, our objective was to provide relevant insights into the current state of affairs, while striving to discern evolving patterns within the landscape of green finance research.

Specifically, the key innovations of this study include the following:

Integration Across Subfields and Related Domains: This research systematically integrates multiple subfields within green finance, such as green FinTech, green financial products and derivatives, green building, financial reform and innovation, and carbon trading markets. By providing a comprehensive view across these domains, this study reveals multidimensional development trends in green finance, addressing the limitations of the single-domain focus in the existing literature.

Expanded Econometric Analysis and Introduction of Emerging Research Areas: Our study not only covers a longer time span but also introduces emerging areas such as the application of green FinTech and the role of policy frameworks, enriching the scope of green finance research. Building on rigorous econometric analysis, we delve further into case studies from top journals to examine issues related to green bonds, ESG rating uncertainties, and carbon reduction, providing readers with layered insights.

Innovative Analytical Framework Combining Quantitative and Qualitative Approaches: To deepen the analysis, we employ a multi-layered framework that integrates quantitative econometric methods with qualitative case studies. By incorporating cases from top journals within our econometric analysis, we offer a nuanced interpretation of key themes in green finance and their policy implications, offering empirical support valuable to both academia and policymakers.

Guidance at the Intersection of Academic and Policy Practice: This study offers actionable policy recommendations on targeted topics, such as green bonds, ESG rating standardization, and the role of major institutional investors in carbon reduction. The proposed policy frameworks and implementation paths provide practical reference points for future policy formulation and industry practices.

2. Literature Review and Overview of Subfields of Green Finance

In this section, hot topics in green finance are listed and reviewed, including green financing, green financial technology (FinTech), green building, green derivatives, green energy development, green finance reform, and the carbon trading market. Here, we only cover the hot topics in economics and finance. We firstly give a brief review of all topics.

The selection of these subfields is based on their essential roles in advancing green finance and sustainable development. In particular, green FinTech and green derivatives, as rapidly evolving areas, have become integral to green finance research and practice. Through innovative financial instruments and technological advancements, they have driven the evolution of green investment and financing models.

While green building and green energy may not strictly align with the core definition of green finance, they are closely related. Green building contributes significantly to achieving sustainable construction and urbanization goals, while green energy is essential for transitioning energy structures and reducing carbon emissions. Although both green building and green energy operate as independent industries, they rely heavily on green finance, especially in terms of capital needs. Green finance, through instruments such as green bonds and green funds, can provide the critical capital support required by these fields. Therefore, we include green building and green energy within our research framework, discussing them as application areas of green finance.

2.1. Green Financing

2.2. Green FinTech

2.3. Green Financial Products and Derivatives

2.4. Green Building

2.5. Green Energy Development

2.6. Green Finance Reform and Innovation

2.7. Carbon Trading Market

2.8. Recent Advances in Green Finance Research in Leading Journals over the Past Three Years

Driven by the global urgency around climate change and sustainable development, green finance has received significant attention in top-tier journals, with key research areas focusing on green bonds, ESG rating uncertainty, the role of institutional investors in carbon reduction, and risk management for green assets.

Together, these studies illustrate the multidimensional advancements in green finance, offering empirical evidence and theoretical frameworks to guide policymakers and investors in addressing climate change.

3. Methodology

3.1. Source, Research Protocol, and Literature Screening Process

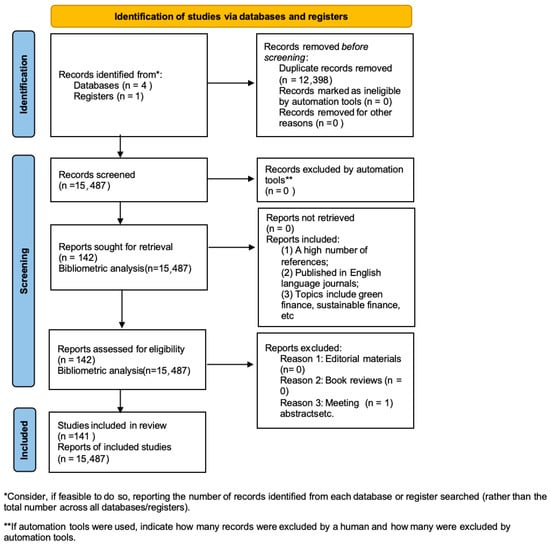

This study followed the rigorous protocols of a systematic literature review to ensure methodological thoroughness and the reproducibility of the results. The literature screening process was completed according to the following steps:

3.1.1. Literature Search Strategy

To enhance the credibility of our study, we sourced our research data from the Web of Science Core Collection, an academic repository integrating information from over 18,000 scholarly journals across disciplines, including natural sciences, engineering, technology, biomedicine, social sciences, arts, and humanities. Recognized as an authoritative source for academic data in finance, Web of Science provides a user-friendly interface with various retrieval methods, enabling efficient content selection, result analysis, and data export.

To ensure comprehensive coverage of core research in green finance, we applied a systematic literature search in Web of Science using the following keywords: “green finance”, “green insurance”, “green securities”, and “green investment”. Our search focused on studies published between 2014 and 2023 to capture recent research developments. The included document types were primarily academic journal articles and conference papers, restricted to original research and review articles.

3.1.2. Literature Screening Process

Deduplication: Automated tools filtered out 12,398 duplicate records from the initial 27,885 records, resulting in 15,487 unique studies for further screening.

Inclusion Criteria: Following our research design, we strictly selected only high-citation, English-language publications focusing on green and sustainable finance topics. These studies proceeded to full-text retrieval and further analysis.

Exclusion Criteria: Of the 142 studies in the final evaluation stage, we excluded 1 conference abstract. Thus, the final selection comprised 141 studies that met all screening criteria.

3.1.3. Inclusion and Exclusion Criteria

During screening, we applied the following criteria:

Inclusion: High-citation, English-language journal articles or conference papers addressing core topics in green finance.

Exclusion: Editorials, book reviews, and conference abstracts lacking peer review were excluded from consideration.

3.2. Bibliometric Analysis

The specific bibliometric methodology employed in this study includes the following parameters: Top 50 per slice, Link Retention Factor (LRF) 3.0, L/N = 10, LBY = 5, and e = 1.0. The “Top 50 per slice” criterion is a stratified selection method in bibliometric analysis, segmenting the study period into several slices, within which the 50 most cited articles are selected. This approach aims to identify the most influential works in each time slice. The LRF of 3.0 is used to manage the number of edges in the network, indicating that the network will retain three times the original links, thus preserving a greater number of relationships and facilitating the construction of a comprehensive knowledge map. The ratio L/N = 10, where L denotes the number of citations per article and N represents the total number of cited articles, ensures that only articles cited in at least 10% of the total citations are retained, filtering for the most impactful literature. The parameter LBY = 5 specifies that only literature published at least five years is considered, thereby excluding recently published articles that may not have gained traction, thus ensuring the stability and reliability of the analysis. Lastly, the parameter e = 1.0 is utilized to maintain the granularity of the network, ensuring that connectivity between each node and its associated nodes is preserved, allowing each node an equal opportunity for participation in subsequent clustering and analysis.

The research process unfolds in two main stages: first, a comprehensive analysis of selected publications, encompassing articles per year, authors’ country of origin, and institutional cooperation networks; second, cluster analysis that identifies key markers in the field through network classification and clustering to uncover the latest developmental trends. This includes co-citation analysis, landmark node analysis, co-cited author analysis, and analysis of references with citation bursts.

The citation burst analysis, central to this study, is a bibliometric technique designed to detect papers that have experienced a sudden surge in citations within a specific time frame. This method is rooted in Kleinberg’s burst detection algorithm, which is widely used for identifying temporal trends in data streams. The strength of citation burst analysis lies in its ability to pinpoint moments of paradigm shifts in research. This makes it particularly valuable for green finance, where rapid policy and market responses are often tied to groundbreaking studies. Understanding these bursts allows policymakers and researchers to trace the origins of influential ideas and adapt strategies accordingly.

For example, in our study on green finance, the citation burst analysis identified several key papers that marked a turning point in academic interest towards sustainability transitions and policy-driven green innovations. By detecting these bursts, we were able to map how specific findings catalyzed broader discussions in the field.

4. Descriptive Statistical Analysis

4.1. Selected Publication Analysis

4.1.1. Articles per Year

4.1.2. Authors’ Countries of Origin

Moreover, a potential limitation of the bibliometric analysis employed in this study warrants acknowledgment. Papers that exhibit high levels of innovation but possess lower citation counts may be overlooked, which could skew the identification of research hotspots toward more widely cited works that do not necessarily reflect groundbreaking contributions. Therefore, while China’s dominance in green finance research is evident in terms of publication volume, further investigation is required to ascertain whether this dominance translates into a leadership position concerning research impact and innovation within the field.

4.1.3. Cooperation Network of Institutions

4.2. Co-Citation Analysis

Cluster #0 green innovation

Cluster #1 financial development

Cluster #2 green buildings

4.3. Analysis of Landmark Nodes

4.4. Analysis of Co-Cited Authors

4.5. Analysis of References with Citation Bursts

The analysis highlights that the majority of keywords associated with citation bursts in the realm of green finance are linked to the term “green”. Notably, the concept of the green economy accounts for the highest proportion of activity, with peak citations observed between 2013 and 2018. This trend can likely be attributed to the heightened global emphasis on environmental protection during this period. However, the onset of the Sino-US trade war, ongoing geopolitical volatility, and rising raw material prices have fostered a prevailing pessimism regarding long-term investments, leading to a decline in the popularity of research focused on the green economy.

Furthermore, the analysis indicates that the content of these citation bursts aligns with the three previously identified clusters: Cluster #0 (Green Innovation), Cluster #1 (Financial Development), and Cluster #2 (Green Buildings).

4.6. Relevance of Top-Tier Findings to Quantitative Results

5. Implications of the Findings

5.1. Policy

The findings of this study have significant implications for decision-making and policy formulation regarding green finance and sustainable development. The outcomes will influence both existing and prospective policies within the sector. In the long term, persistent scarcity of raw materials and ongoing regional conflicts in the post-pandemic era have heightened tendencies to make short-term investments. Building upon this foundation, the primary research focus for scholars in green finance should be to enhance investor confidence and propose relevant policy recommendations. Our research illuminates areas where policy adjustments and regulatory frameworks are essential to improve the current landscape.

This evaluation includes assessing whether existing or newly proposed green finance policies align with or contradict social welfare objectives. Additionally, our study investigated methodologies for evaluating and measuring the effectiveness of environmental policies. We aimed to explore how various green taxes can be employed to fund vital public services and effectively achieve environmental goals, particularly in countries and regions characterized by varying levels of development and conditions.

5.1.1. Promotion and Regulation of Green Bonds

Green bonds showed the highest emergence intensity from 2022 to 2023, indicating rapid growth in this area. We recommend optimizing the policy framework for green bonds through tax incentives, disclosure requirements, and other measures to enhance market transparency and attract long-term investments.

5.1.2. Cross-Border Support for Climate Finance

Climate finance gained significant attention between 2020 and 2023. Policymakers should foster international collaboration in climate finance, such as establishing cross-national climate funds to assist low-income countries in addressing climate change challenges.

5.1.3. Enhancement of Corporate Environmental Performance

Since 2018, environmental performance has been a focal area. Policymakers can encourage this by establishing environmental performance standards and incentive policies, thus improving corporate environmental awareness and execution, driving a broader industry-wide green transformation.

5.1.4. Support Policies for Energy Efficiency Improvements

Energy efficiency is a crucial component of a low-carbon economy. Policies can support energy-saving retrofits and technological research and development to bolster the application of energy efficiency in economic activities.

5.2. Practice

This study provides a strategic framework for researchers in green finance, guiding them in identifying suitable empirical research directions that could help reduce overall financing costs. Based on the results of the “keyword burst analysis”, we recommend further exploration of green finance technologies—such as green bonds and climate finance—as well as practical applications of environmental regulations. Table data indicate that keywords like “green bond” and “climate finance” showed high burst values during 2022–2023, signaling strong development potential and significant research interest in these areas. Addressing the challenges these areas present is essential to advancing green finance.

5.2.1. Focus on Technological Applications and Social Impact

Researchers should prioritize examining the application of new technologies within green finance, particularly in areas such as green bond issuance and carbon credit trading, and assess their potential social impact. Table data reveal high burst values for terms such as “environmental performance” and “energy efficiency”, underscoring substantial, yet underexplored, opportunities for enhancing corporate environmental performance and energy efficiency. In the current economic climate, green innovation faces considerable barriers, particularly due to the dual externalities involved. The development and innovation of environmental products often entail significant costs, while the private returns are notably lower than the broader social benefits. Our findings fill a critical gap in understanding green finance innovation, highlighting the underappreciated costs of clean production and the disparity between private and social returns on innovation.

5.2.2. Policy Mechanisms and Financial Support

This study emphasizes the need to enhance private returns on green innovation through financial mechanisms, thereby supporting the sustained development of green FinTech applications. For instance, the keyword burst results for “green economy” and “corporate governance” suggest that corporate governance plays a pivotal role in green transitions. Policymakers could consider establishing incentive mechanisms, such as interest rate subsidies on green loans or tax incentives, to make green innovation projects more financially attractive, thus encouraging greater participation from private investors.

5.2.3. Aligning Corporate Profit Motives with Strategic Environmental Objectives

Moreover, the results underscore the necessity of aligning corporate profit motives with strategies to address the inherent dual externality issues in green finance. This alignment is crucial to prevent corporations from prioritizing short-term profits at the expense of long-term environmental responsibilities. Keywords like “environmental performance” and “supply chain management” reflect the importance of environmental performance and sustainable supply chain practices within green finance. Accordingly, we recommend that policymakers integrate oversight and incentive mechanisms that encourage firms to adopt proactive measures in green supply chain transformation, thereby fostering long-term environmental accountability within corporate strategies.

5.3. Further Research

First, researchers should prioritize evaluating the impact of green financial products and derivatives on the advancement of green finance, with the aim of establishing a unified international platform for these instruments. Initially, the evolution of green finance largely relied on traditional financial instruments. However, with the continuous advancement of emerging technologies, the narrative surrounding green finance is increasingly intertwined with these innovations. The widespread adoption of the Internet and the availability of big data facilitate a deeper understanding of environmental changes, effectively connecting green finance with traditional sectors significantly influenced by environmental factors, such as agriculture and heavy industry. This synergy has led to the rapid development of green financial products and derivatives, expanding beyond simple instruments like green bonds and weather derivatives. Despite these advancements, considerable gaps remain. It is essential to further standardize the trading norms for these financial products and derivatives and to establish a well-organized international platform that encompasses exchanges, trading centers, and related networks to guide the evolution of green finance.

Second, as an extension of the previous point, researchers should closely examine the application of cutting-edge technologies in related fields and their societal impacts. This paper highlights the transformative role of technology in green finance, while concurrently noting that companies with environmentally sustainable agendas are at the forefront of technological innovation within the green sector. For instance, several firms in heavily polluting industries have made substantial investments in advanced green technologies, supported by government industrial policies. Consequently, the green strategies of these firms, along with their technological advancements, serve as vital sources of practical research ideas. Investigating questions related to the potential impact of new green technologies on the industry, the societal challenges associated with their implementation (such as financing constraints), and the subsequent transformation of the green industry landscape offers fruitful research opportunities amid the dynamic evolution of emerging technologies.

Third, researchers need to focus more on understanding the interplay between green finance policies and innovation. As previously discussed, green finance policies play a critical role in promoting green finance and its associated industries. However, these policies can inadvertently lead to issues such as excessive bank credit and inefficient investments by enterprises. An intriguing area of inquiry involves establishing reasonable criteria for evaluating the appropriateness of these policies through the lens of green finance. Questions concerning the duration for policy evaluation, the historical data utilized for policy formulation, and the potential variation in outcomes based on different historical periods warrant careful examination. Are these policies only relevant in the short term? Unfortunately, there is a scarcity of research addressing these crucial aspects within the green finance domain.

In addition to these research directions, despite the burgeoning growth of green finance in emerging economies such as India, research in other developing countries remains in its infancy. Future empirical studies could focus on these nations and regions. Furthermore, with the rise of big data, updating high-quality datasets is crucial. Classic problems in green finance deserve renewed attention, and the application of novel learning methodologies can assist in establishing effective learning mechanisms within the green finance market, facilitating the identification of appropriate targets. Addressing these issues will undoubtedly inspire further research and contribute to the ongoing development of green finance.

6. The Interaction Between Different Fields of Green Finance

This section provides a comprehensive discussion of the interrelationships within green finance, emphasizing the connections between green financing and financial technology (FinTech), green financing and green building, as well as the interactions between green derivatives and green energy development. Additionally, it explores the intersections of green finance with other domains, particularly focusing on the roles of information disclosure and cultural factors. Understanding these interactions is vital as it informs stakeholders about potential synergies and challenges in implementing green finance strategies across sectors, thereby enhancing the overall impact on sustainable development.

6.1. Green Financing, Green Bonds, and Financial Technology (FinTech)

6.2. Green Finance and Information Disclosure

6.3. Intersection with Cultural Factors

Cultural factors exert a profound influence on the adoption and effectiveness of green finance. Consumer demand for green finance products, their acceptance, and the level of support from policymakers vary significantly across different cultural contexts, all of which impact the promotion and implementation of green finance.

7. Limits of This Research

While this study employed CiteSpace as a bibliometric analysis tool, it is crucial to acknowledge certain methodological limitations that may have influenced the accuracy and comprehensiveness of the results.

First, CiteSpace relies extensively on the construction of citation networks to identify the key literature and research hotspots within a given scientific field. The effectiveness of this approach is contingent upon the quality and scope of the underlying database. Incomplete or inaccurate citation data can introduce bias into the analysis, potentially skewing the results. Additionally, CiteSpace typically employs citation count-based metrics to assess the significance of the literature, which may overlook the diversity of content quality and academic impact. For instance, highly innovative yet infrequently cited papers may be marginalized, causing the identification of research trends to favor widely cited works that do not necessarily represent groundbreaking contributions.

Second, the slice-based temporal analysis method utilized by CiteSpace presents certain limitations. Although analyzing research trends across different time intervals provides valuable insights, this method may fail to capture the continuity of research that spans multiple time slices or evolves gradually over time, leading to a fragmented understanding of the research landscape. Furthermore, the selection of time slices may introduce subjectivity, as differing temporal divisions can yield varying analytical outcomes, thus affecting the stability and reliability of research conclusions.

CiteSpace also encounters challenges when dealing with multidisciplinary research. Given that its analytical framework is primarily based on citation networks, it may struggle to accurately capture and analyze literature that spans different academic disciplines, each with its own citation practices and standards. This limitation can restrict the tool’s applicability in interdisciplinary research, where the integration of knowledge from diverse fields is crucial.

Finally, while CiteSpace excels at visually representing citation networks and research hotspots, the interpretation of these visualizations often requires a high level of domain-specific knowledge and technical expertise. The complexity of the visual outputs may lead to misinterpretations by researchers who are less familiar with the tool, potentially compromising the accuracy of the derived conclusions. Therefore, when using CiteSpace for bibliometric analysis, researchers should supplement its findings with other qualitative and quantitative methods and exercise caution in interpreting the results, to mitigate the risks associated with the tool’s inherent limitations.

8. Conclusions

The emergence and evolution of green finance are driven by increasing environmental concerns alongside the continuous development of the global economy. As a sector dedicated to sustainable development, green finance has garnered significant attention from scholars. A comprehensive review of green finance is beneficial for advancing research in finance. The global impact of green finance is both substantial and far-reaching. This paper examines the challenges inherent in the emergence of green finance and proposes corresponding countermeasures. Utilizing a research sample from the Web of Science, we conducted a scientometric analysis of papers related to green finance in leading business, economics, and management journals from 2013 to 2022. Initially, we performed a descriptive statistical analysis of overall publication growth, primary research fields, and relevant research institutions. Subsequently, we undertook a co-citation analysis using CiteSpace to examine clusters and citation bursts in green finance research.

Drawing on this analysis, we conclude that green finance has witnessed significant growth over the past decade, characterized by an increase in the number of journals and a shift in the research center from the United States to China. While numerous developing countries have contributed to green finance research, the concentration remains predominantly in developed nations, particularly the United States and the United Kingdom, with China emerging as a leader.

Among the most influential institutions, the Chinese Academy of Sciences, Jiangsu University, and Wuhan University rank as the top three in citations. Collaborative efforts are evident among these institutions, demonstrating strong academic networks.

In terms of citation frequency, the top five authors—Wang Y, Shahbaz M, Lin BQ, Zhang DY, and IEA—have significantly influenced the field. Some have introduced new research concepts or directions in green finance’s emerging areas, while others have synthesized existing knowledge across its subfields. Their collective contributions have expanded the scope of green finance and transformed it from an academic pursuit into an industry practice.

An examination of the evolution of green finance over the past decade reveals a focus on its primary research areas: green finance, investment, and bonds. Scholars in this field continually broaden these dimensions, extending their inquiry from academia to industry applications.

This study contributes to green finance research through a systematic and scientometric approach, providing an objective review of the research history. Compared to traditional literature reviews, scientometric analysis offers greater objectivity, mitigating biases stemming from manual judgment. Moreover, it allows for the analysis of more extensive samples, aiding researchers in related fields. Through cluster analysis of co-cited papers, we identified salient issues in green finance research, ensuring robust findings. Moreover, our temporal analysis offers a historical perspective on trending topics in green finance research. The transformation of green finance research from a narrow focus to a broader context is evident. Finally, this study assists scholars and practitioners in identifying key journals, authors, and institutions in the field of green finance. In summary, we propose a comprehensive research agenda for integrating green finance into research efforts with technological, economic, and managerial perspectives, centered on systematically identifying and addressing significant gaps in the literature.

9. AI Statement

The grammar and language refinement of this article were enhanced using artificial intelligence technology. Employing an advanced AI language model, the original manuscript underwent a thorough grammatical review and lexical optimization, thereby improving the overall fluency and precision of expression. The AI tool efficiently identified and corrected grammatical errors, inappropriate word choices, and structural inconsistencies within the text, ultimately rendering the article more professional and readable.

Source link

Xin Yun www.mdpi.com