India’s population has risen to around 1.46 billion in 2025, bringing along some significant socio-economic challenges, such as food security. According to the ‘State of Food Security and Nutrition in the World’ report, 13.4% of people are undernourished, which highlights the food insecurity scenario in India. Arable land is under tremendous pressure due to an increasing population. The agriculture sector is also facing numerous sustainability challenges for which soil health management is important.

While chemical fertilizers rapidly increase crop yield, they also cause deterioration in the soil’s well-being. The Government of India is supporting organic agricultural practices, such as promoting biofertilizers, which make the nutrients that are already present in the soil usable for plants.

According to Pristine Market Insights, the biofertilizer market in India is valued at $375 million in 2024 and is forecasted to reach $820 million by 2030, rising at 14% CAGR. Among the Indian states, Tamil Nadu holds 14% market share, followed by Maharashtra, which holds 13% and Andhra Pradesh at 11% market share. This article highlights the key growth drivers, potential barriers and the future outlook of the Indian biofertilizer market.

Current agricultural challenges

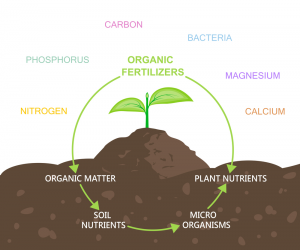

Biofertilizers contain living cells of different types of microorganisms that enhance the nutrient quality of the soil and improve plant growth. These microorganisms colonize the interior of the plant directly or indirectly when applied to seeds, soil or plant surfaces and encourage growth by increasing the availability of nutrients to their host. This nutrition supply is done in various ways, such as nitrogen fixation and the solubilization of phosphorus. They restore the natural nutrient cycles in the soil and help to build up organic matter in the soil.

Advantages of biofertilizers:

- They improve soil texture, water holding capacity as well as restore natural soil fertility.

- They enhance nutrient availability and uptake by plants.

- They are a renewable source of nutrients that reduce the dependency on synthetic agro-

- They increase crop yield and quality.

Growth factors for biofertilizer market in India

Government support and policy initiatives

The government has introduced a new initiative known as the Prime Minister’s Programme for Restoration, Awareness Building, Nourishment, and Amelioration of Mother Earth (PM-PRANAM), which was passed in the FY2023-24 budget. This program presents a solution to improve soil health by advocating for biofertilizers and organic options while also reducing the cost of subsidizing chemical fertilisers that put a strain on government finances.

Other government initiatives include the development of liquid biofertilizer technology with a higher shelf life by the Indian Council of Agricultural Research (ICAR). They also developed improved strains of biofertilizers specific to different crops and soil types. Some other government schemes include Paramparagat Krishi Vikas Yojana (PKVY) and Mission Organic Value Chain Development in North East Region (MOVCDNER) which provide support to the farmers from production to marketing and promote organic cultivation using organic inputs.

Advances in technology and innovation

Advanced microbial formulations, delivery systems, such as encapsulation techniques and liquid biofertilizer technology, are improving the stability and efficacy of these products. The liquid biofertilizers are suspensions with useful microorganisms that fix atmospheric nitrogen and solubilise insoluble phosphates, making it available for the plants.

Expanding agricultural activities and agro exports

India has witnessed a surge in urbanization in recent years, causing a rising demand for agricultural food products. India also exports a significant number of agricultural products to other countries, leading to increased farming activities. This growth in agriculture is driving India’s biofertilizer market and in turn promoting sustainable agriculture in India.

Private sector participation

Chemical fertilizer companies like KRIBHCO are expanding their biofertilizer portfolio. In September 2024, KRIBHCO and Novonesis signed an MoU announcing their collaboration. As a part of this, Indian farmers across all crops will be offered a Mycorrhizal Biofertilizer product- ‘KRIBHCO Rhizosuper’, which is powered by Novonesis Promoter Technology.

Barriers for the Indian biofertilizer market

Despite the positive outlook, some challenges hinder the biofertilizers market’s growth:

- Low awareness and training – There is still low awareness of the benefits of using biofertilizers in farming, or farmers don’t have sufficient knowledge of using them efficiently, leading to a gap in the market.

- Higher cost than chemical fertilisers – Chemical fertilisers have a lower cost than biofertilizers, due to which they are the preferred choice for most of the smallholder farmers.

- Storage and shelf life issues – Biofertilizers are incorporated with live microorganisms in them, which makes their shelf life comparatively lower than that of traditional chemical fertilisers. This increases farmers’ inclination towards conventional fertilisers.

Key Indian market players

- IPL Biologicals: IPL Biologicals offer a wide range of premium biofertilizer products in the biofertilizer segment and are certified as organic. Bio NPK, which is a high-grade liquid biofertilizer with a higher microbial density, is priced at INR 1,075/litre. Biosol-P, a phosphate solubilizer, enhances the soil phosphorus availability, costs INR 650/litre. In addition, Nirsosol, a liquid nitrogen-fixing biofertilizer which cots around INR 600/litre helps in targeting cereal crops, improves soil nitrogen balance.

- KRIBHCO (Krishak Bharati Cooperative Ltd): KRIBHCO offers a diverse product range with affordable pricing and strong government backing. Their liquid NPK2 biofertilizer is a popular choice among farmers as it is cost-effective, i.e. at INR280/litre. Rhizobium, a nitrogen-fixing biofertilizer, has been a popular choice for leguminous crops, and especially used in pulse cultivation, costs around INR200-250. This shows that the biofertilizer prices vary widely in India. Premium brands charge on the higher end due to the higher microbial content in their products. Farmers can choose according to their farming needs and budget.

Future Forecast

The biofertilizer market in India can scale up by increasing awareness and technology adoption among farmers. Conducting farmers’ outreach programs and sharing information about the adverse environmental effects of using chemical fertilisers, especially for the smallholder and medium-scale farmers in villages, can motivate the use of biofertilizers. Based on the current trajectory in the biofertilizers market, more farmers will start using biofertilizers as a result of increased awareness of environmental sustainability.

Author Bio: Rina Bhosale is a skilled market research analyst and accomplished writer with a deep interest in sustainable agriculture and environmental innovations.

Source link

ecoideaz ecoideaz.com