After days of intense political infighting between ultra-conservative and moderate Republicans, the House of Representatives voted along party lines on Thursday morning to approve a sweeping tax bill that seeks to eviscerate the heart of landmark climate legislation passed by Democrats just three years ago.

The 2022 climate law on the chopping block, the Inflation Reduction Act (or IRA), was the first legislation in more than a decade to attempt to slash American greenhouse gas emissions and the centerpiece of former president Joe Biden’s legislative agenda. It provides hundreds of billions of dollars in tax credits, loans, subsidies, and grants to utility companies, automakers, consumers, and others to become more energy efficient and switch to sources of carbon-free power.

Until recently, the conventional wisdom in Washington was that lawmakers in districts receiving this cash would be disincentivized to undo the legislation supplying it, even under an ultra-conservative president like Donald Trump. “Repeal is extremely unlikely,” Neil Chatterjee, a former Republican commissioner of the United States Federal Energy Regulatory Commission, wrote in an opinion piece for The Hill last August titled “The Solar Investment Tax Credit is safe from repeal even if Republicans win in 2024.” In March, 21 House Republicans signed an open letter calling for any changes to the IRA tax credits to “be conducted in a targeted and pragmatic fashion.”

Yet the House voted 215-214 on Thursday to wind down the IRA’s clean energy tax credits ahead of schedule, including the solar investment tax credit that Chatterjee was sure would be safe. Just two Republicans voted against the bill, one voted present, and two abstained — including only one of the March letter’s signatories.

Originally, the incentives were set to continue through at least 2032. Under the House bill, tax credits for all clean energies except for nuclear, which Republicans tend to view favorably, will apply only to projects that break ground within 60 days of the bill’s enactment and begin sending energy to the grid by the end of 2028, a timeline that could seriously undercut the country’s clean energy industry. Federal tax credits to help consumers adopt clean energy technologies like heat pumps, rooftop solar, battery storage, and electric vehicles would be phased out by the end of this year.

The House bill needs to be passed by the Senate and signed by President Trump in order to become law, and it is likely to change during negotiations in the upper chamber.

Megan Jelinger / AFP via Getty Images

Renewable energy developers warn that the House’s timeline for getting projects in service is prohibitively tight and would effectively make some of the tax credits obsolete. “If Congress does not change course, this legislation will upend an economic boom in this country that has delivered an historic American manufacturing renaissance,” said Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association, in a statement.

The repeals would impact major utility-scale projects that are already underway, like wind projects, said Katrina McLaughlin, an associate on the World Resources Institute’s U.S. energy team, because it takes a long time to get most renewable projects up and running.

“Placed in service means everything has to go right. We have interconnection queue delays, we have permitting delays, there can be challenges with getting different materials and resources,” McLaughlin said. “So getting in service by 2028 is actually a pretty aggressive timeline.”

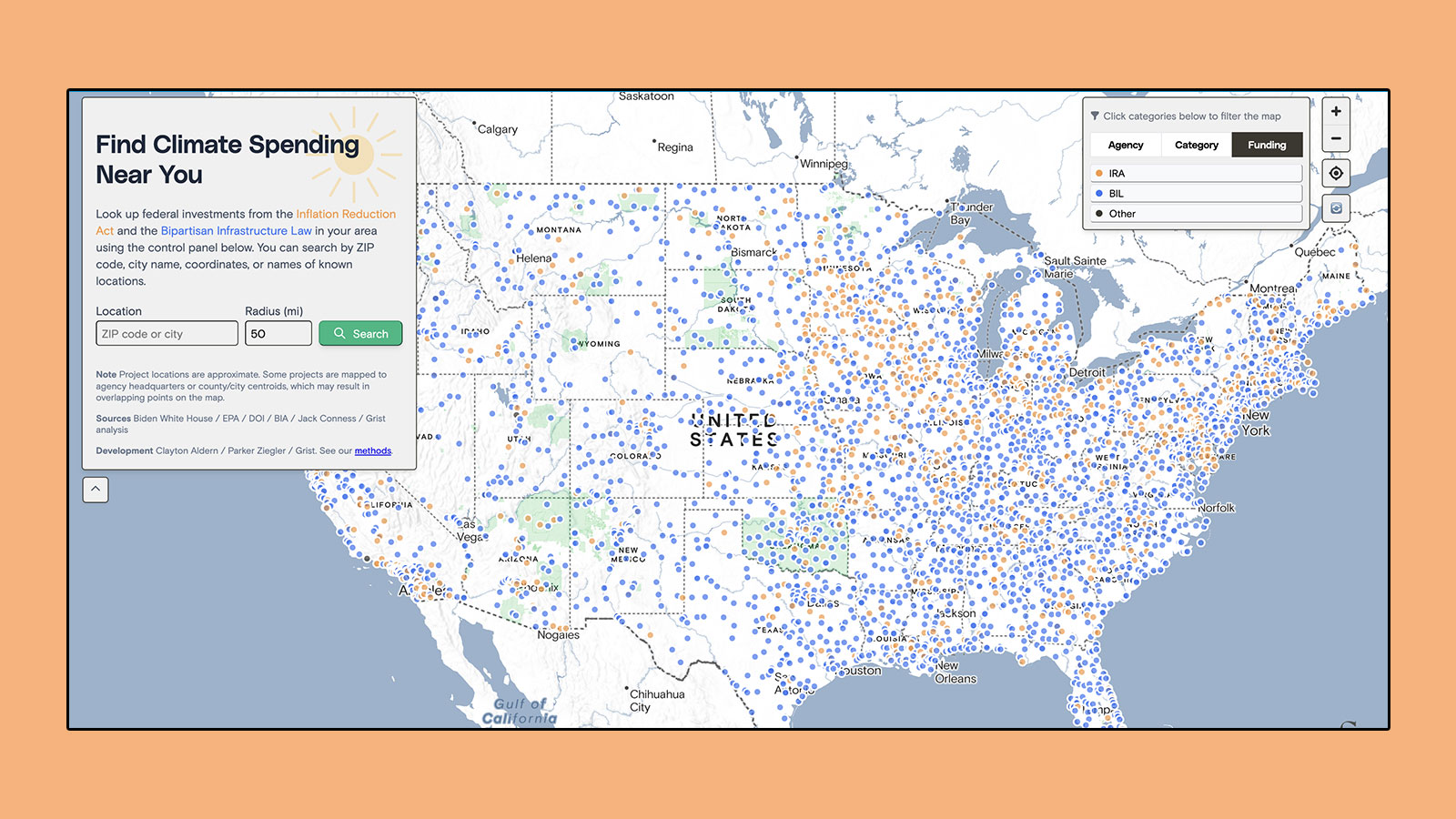

In the two years since the IRA was passed, analyses show that the federal funding has catalyzed more than $400 billion in investments in manufacturing, electric vehicles, hydrogen power, renewable energy, and other green initiatives, and spurred more than 400,000 new jobs. Analyses show that the vast majority of IRA clean energy tax credits and grants — 78 percent — have gone to red districts in rural and suburban areas.

As House Speaker Mike Johnson sought to unite his party behind Trump’s domestic agenda, two warring factions emerged: a far-right coalition focused on attaining deeper spending cuts by slashing the IRA and Medicare, and a moderate group agitating to retain clean energy funding in their districts and increase the cap on how much state and local tax can be deducted from one’s federal taxes — a change that would benefit high earners in blue states.

Unsurprisingly, the lawmaker leading the fight against the IRA comes from an area that hasn’t gotten much money from it. Representative Chip Roy, leading the ultra-conservative crusade, represents a district in Texas that has a little less than a dollar per person in announced IRA investments. Meanwhile, one of his colleagues on the other side of the fight, moderate Republican Representative Nancy Kiggan, comes from a district in Virginia that is slated to receive $85.50 worth of investments per capita.

Republicans represent 18 of the top 20 congressional districts benefiting the most from clean energy investments since the passage of the IRA, according to the research firm Atlas Public Policy. The top three districts on that list, in North Carolina, Georgia, and Nevada, had together received nearly $30 billion from the legislation as of March this year. But in the end, all of the Republican lawmakers representing those 18 districts voted in favor of effectively ending the investments. Democrats, whose caucus has shrunk due to the deaths of three members this year, were united in opposition.

In the end, the moderate Republican caucus was willing to trade IRA tax credits for other policy priorities. Moderates in high-tax states like New York were willing to use Biden’s tax credits as a bargaining chip for a higher limit on itemized state and local tax deductions — $40,000, up from the current cap of $10,000 — a political win that those lawmakers could reap the benefits of immediately and allowed them to sidestep having to defend legislation passed by a Democratic administration.

Republicans might also be banking on the fact that many of their constituents don’t know about the IRA. A University of Chicago and Associated Press survey last year found that, two years after the IRA passed, most Americans had a supremely flawed understanding of what the legislation is and does, if they knew about it at all. Only 21 percent of adults polled, for example, thought tax credits for individuals to buy electric vehicles were helpful. Nearly 40 percent didn’t know enough to weigh in on the EV tax credits and a shocking 15 percent of those polled thought the policy — which gives consumers up to $7,500 for a new plug-in EV — hurt people like them.

According to Josh Freed, senior vice president for climate and energy at the think tank Third Way, part of the problem is that the IRA’s clean energy incentives — like new union jobs, major infrastructure projects and new union jobs — take years to manifest. “Not enough clean energy funding got out the door quickly enough,” he said. “It’s having a big impact, don’t get me wrong, but it hasn’t become part of the fabric of communities yet in a way that would freak people out if it disappeared.”

Source link

Zoya Teirstein grist.org