1. Introduction

The European Commission’s Directive on Corporate Sustainability Due Diligence (the directive henceforth) represents a landmark regulatory effort to embed sustainability principles into the fabric of business operations within the European Union (EU). Starting its adoption process on 23 February 2022, this directive sets forth stringent requirements for companies to systematically identify, prevent, and mitigate harmful effects on human rights and the environment throughout their operations and supply chains (

European Commission 2022). The directive’s adoption followed extensive consultations and negotiations, reflecting the EU’s commitment to addressing global sustainability challenges and promoting responsible business conduct (

Santaguida 2023).

The aim of this research article is to analyze the impact of the European Commission’s Directive on Corporate Sustainability Due Diligence on European entrepreneurial activity, ecosystems, and innovation. The methodology adopted for this research is a comprehensive literature review, guided by the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) approach, which ensures a systematic and transparent process in identifying, screening, and synthesizing relevant studies. Through this method, this study critically examines the existing literature and case studies, applying comparative frameworks and impact assessments to understand the challenges and opportunities presented by the directive. The findings provide insights into how the directive influences startups and small and medium-sized enterprises, along with potential policy recommendations to support these entities in navigating compliance while fostering innovation and sustainability.

One of the innovative aspects of this directive is the introduction of a ‘safe harbor’ exemption, which could release companies from legal actions upon proof of a valid due diligence assessment (

Poiedynok 2023). This provision balances corporate accountability with companies’ practical challenges in ensuring compliance across complex global value chains. The directive also includes obligations related to climate change targets and harmonizes aspects of directors’ fiduciary duties, further embedding sustainability into corporate governance frameworks (

Ventura 2023).

On 24 May 2024, the EU Council formally approved the directive, marking a significant milestone in the EU’s legislative process. This formal approval underscores the importance of EU institutions on corporate accountability and sustainable development (

Bueno et al. 2024). The directive mandates that companies integrate due diligence processes into their corporate policies, continuously monitor compliance, and report on their efforts to address adverse impacts (

Santaguida 2023). These requirements apply not only to large enterprises but also to startups and small and medium-sized enterprises (SUs and SMEs) operating in high-impact sectors, thereby broadening the scope of the regulation to include a significant portion of the EU’s business landscape (

Korka-Knuts 2024).

A notable aspect of the directive is its focus on human rights and environmental obligations within global value chains. This comprehensive approach ensures that European companies are held accountable for their operations worldwide, promoting ethical business practices and sustainability (

Partzsch 2024). For instance, the directive includes provisions that require firms to develop and implement climate change plans, a significant step towards aligning corporate activities with the EU’s climate goals (

Feigerlová 2024).

The directive aims to harmonize due diligence procedures across the EU, creating a level playing field for firms and ensuring that all businesses contribute to sustainable development (

Solodovnik 2022). This effort is crucial as it builds on existing international frameworks, such as the United Nations Guiding Principles (UNGPs) on Business and Human Rights and the OECD Guidelines for Multinational Enterprises (OECD-GME), reinforcing the EU’s leadership role in promoting global sustainability standards (

OECD 2011;

United Nations 2011). This directive’s adoption and formal approval signals a robust regulatory approach to corporate responsibility, with far-reaching implications for business operations, supply chain management, and stakeholder engagement within the EU (

Santaguida 2023;

Simons 2015).

The directive represents a comprehensive regulatory framework to foster sustainable business practices, protect human rights, and mitigate environmental harm. By requiring companies to take proactive measures to address adverse impacts, the directive seeks to drive a transformative change in how businesses operate and interact with their stakeholders (

Buhmann 2024).

In analyzing the potential impacts of this directive on European entrepreneurial activity, ecosystems, and innovation, it is crucial to consider both the challenges and opportunities it presents. This harmonization standardizes compliance and promotes a more consistent application of sustainability principles across diverse industries (

Szmelter-Jarosz 2022).

One of the primary challenges associated with the directive is the increased compliance costs for businesses, particularly SUs and SMEs operating in sensitive industries. These costs include implementing new reporting systems, staff training, and ongoing monitoring to ensure adherence to the directive’s requirements (

Esenduran et al. 2012). Nonetheless, these expenses can be compensated by the long-term gains of sustainable practices, such as improved risk management and enhanced reputation (

Bachev 2007).

The directive mandates comprehensive due diligence processes for companies operating within the EU, which represents a significant regulatory shift to enhance corporate accountability and promote sustainable business practices (

Ventura 2023). By introducing a general due diligence duty for companies and directors, the directive aims to foster sustainable corporate behavior and redefine the boundaries of firms toward a more sustainable economy (

Ventura 2023).

One of the central areas of focus is the impact on entrepreneurial activity. The directive imposes new compliance obligations on businesses, which can directly and indirectly affect SUs and SMEs. These effects include increased compliance costs, administrative burdens, and potential barriers to market entry (

Solodovnik 2022). For SUs and SMEs, which often run with constrained resources, the financial and administrative demands of complying with the directive can be particularly burdensome (

Esenduran et al. 2012). These additional costs and complexities may deter new market entrants, thus potentially stifling innovation and competition (

Prezioso and Coronato 2013).

However, the directive also offers opportunities for SUs and SMEs to enhance their competitiveness by adopting sustainable business practices. Compliance with the directive can improve risk management, enhance reputation, and open new markets prioritizing sustainability (

Bachev 2007). For example, companies implementing robust due diligence processes may gain a competitive edge by attracting customers and investors, who are increasingly focused on corporate responsibility and sustainability (

Bueno et al. 2024).

Another critical area of examination is the influence of the directive on business ecosystems within the EU. The directive’s requirements for due diligence in supply chains necessitate changes in how companies manage their relationships with suppliers, customers, and other stakeholders (

Ventura 2021). This due diligence can lead to shifts in supply chain management practices, fostering greater transparency and collaboration (

Martín-Ortega 2018). However, it can also introduce complexities and costs that could impact the dynamics of business ecosystems (

Ventura 2021). By requiring businesses to report on their environmental, social, and human rights impacts, the directive aims to promote sustainable business practices across entire supply chains (

Martín-Ortega 2018). Through this analysis, we seek to uncover how the directive might reshape entrepreneurial interactions and networks within the EU, promoting or hindering collaboration among various entities, including businesses, non-governmental organizations (NGOs), and government bodies. Understanding these dynamics is critical for considering the broader implications of the directive on the EU’s business landscape and its contribution to sustainable development.

Innovation is another key dimension to consider. The directive’s emphasis on sustainability can serve as a catalyst for innovation in sustainable practices and technologies. Companies may be incentivized to invest in research and development (R&D) to advance new solutions that comply with the directive’s requirements and mitigate adverse impacts (

Sarkar 2013). This aspect of the analysis will explore whether the directive encourages or stifles innovation and how it influences the allocation of resources toward sustainable development initiatives (

Kus and Grego-Planer 2021). For instance, the EU directive promoting energy use from renewable sources has offered small enterprises in the renewable energy sector opportunities for economic growth through innovation despite challenges related to financial factors and limited resources (

Kus and Grego-Planer 2021).

This article is structured as follows: the next section provides a detailed overview of the European Commission’s Directive on Corporate Sustainability Due Diligence, outlining its key provisions and objectives. Following this, the methodology section describes the systematic literature review approach, emphasizing the use of the PRISMA framework for data collection and analysis. The results section presents the findings of the review, highlighting the directive’s implications for European entrepreneurial activity, ecosystems, and innovation. This is followed by a discussion that contextualizes the results within the broader sustainability and corporate governance landscape. Finally, the article concludes with policy recommendations and suggestions for future research, aiming to support entrepreneurs and policymakers in adapting to the directive’s challenges and leveraging its opportunities for sustainable development.

2. Methods

2.1. Preferred Reporting Items for Systematic Reviews and Meta-Analyses

This research utilizes a scoping review methodology to explore the entrepreneurial impact of the directive. Scoping reviews systematically gather, assess, and synthesize the existing literature to highlight key concepts, evidence types, and research gaps within a field (

Arksey and O’Malley 2005). This method effectively maps the directive’s multifaceted implications by examining the literature, frameworks, impact assessments, and case studies (

European Commission 2022). It offers a thorough analysis of how the directive affects various business operations, with a particular focus on SUs and SMEs (

European Innovation Council and SMEs Executive Agency n.d.).

This study applies the scoping review method following the PRISMA framework for scoping reviews (

Tricco et al. 2018). The analysis draws on a broad range of sources, including legal texts, policy documents, and the academic literature. Primary materials comprise the European Commission’s Directive and related EU regulations (

European Commission 2022) while secondary sources include academic research, international reports, and policy briefs that provide context and insights into the directive’s framework. Foundational documents, like the OECD-GME and the UNGPs, are integral in shaping the directive’s objectives (

OECD 2018;

United Nations 2011). A systematic search of academic databases, legal repositories, and official EU resources was conducted to capture a comprehensive view of the directive and its broader impacts (

International Monetary Fund 2024;

World Bank 2020).

The scoping review method is especially suited for this study as it facilitates an extensive examination of the directive’s entrepreneurial impact. This method aids in pinpointing crucial sources and evidence types, enabling a detailed assessment of research methodologies and offering a clearer understanding of key insights within the domain (

Peters et al. 2021;

Nadkarni and Prügl 2021). Additionally, it plays a vital role in identifying gaps in the current literature, helping guide future research directions (

Cooper et al. 2018). By conducting a comparative analysis of international sustainability standards, such as the UNGPs, OECD-GME, UK’s Modern Slavery Act, and US Dodd-Frank Act, this method situates the directive within the global regulatory landscape (

United Nations 2011;

OECD 2011;

UK Government 2015;

US Congress 2010). The selected criteria for these comparisons—relevance to corporate sustainability, business impact, and scope—help contextualize the directive and highlight potential best practices and challenges (

Bartley 2018;

Sethi et al. 2017).

The impact analysis evaluates the directive’s likely effects on key business areas, such as compliance costs, administrative load, supply chain management, innovation, and regional disparities (

European Commission 2022). This qualitative analysis relies on a thorough review of the directive’s provisions and their practical outcomes for companies, with a particular focus on SUs and SMEs. Information was gathered through case study reviews, industry report analysis, and expert consultations to pinpoint challenges and opportunities posed by the directive (

Kourula et al. 2017). This approach ensures a comprehensive understanding of how the directive could reshape business practices and interactions within the EU.

Drawing from the literature review and impact analysis, this study offers policy recommendations aimed at optimizing the directive’s impact while minimizing its negative effects on businesses. These recommendations are crafted by identifying best practices from other regulatory models. The focus is on delivering targeted assistance to SUs and SMEs, streamlining compliance procedures, and encouraging innovative solutions to sustainability challenges. This ensures that the directive successfully achieves its sustainability objectives without hindering economic progress (

European Commission 2022;

International Monetary Fund 2024).

To comprehensively identify the relevant literature, this process involves a structured and systematic search across multiple databases and information platforms, ensuring a thorough evaluation of the existing evidence. The search strategy is carefully crafted to address the specific research inquiry, utilizing precise keywords and Boolean operators to capture all pertinent studies. This extensive search includes authoritative databases, such as PubMed, Web of Science, IEEE Xplore, Scopus, Google Scholar, ACM Digital Library, ScienceDirect, JSTOR, ProQuest, SpringerLink, EBSCOhost, and ERIC. The search is expansive, encompassing not only peer-reviewed academic articles but also grey literature, reports, guidelines, case notes, and other relevant materials to ensure a comprehensive review of the topic.

This study incorporates case studies and examples from non-EU countries that have implemented comparable regulations to shed light on the directive’s possible impacts. Selection criteria include alignment with the directive’s goals, detailed available documentation, and demonstrated effects on business operations (

OECD 2021). This approach extracts valuable lessons that can guide the directive’s implementation within the EU, offering practical insights for policymakers and businesses (

Kourula et al. 2017).

The search strategy utilized is dynamic and continuously refined, adapting as new relevant studies emerge. This flexible approach ensures a comprehensive and up-to-date portrayal of the research landscape. Additionally, the process is enhanced by manually reviewing the reference lists of initially identified studies. This careful hand-searching of bibliographies and relevant reviews serves as a crucial complement, uncovering additional studies that may have been missed during the initial database search. This multi-layered and meticulous method ensures the inclusion of the most pertinent and current research in the field (

Horsley et al. 2011).

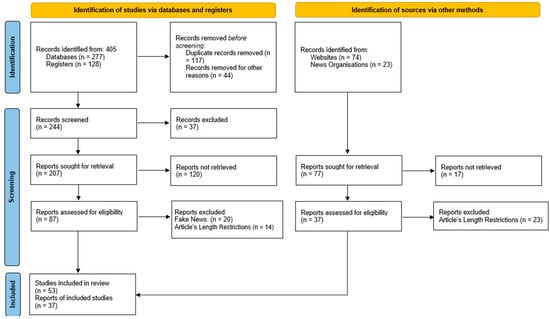

Figure 1 visually represents the article selection process for this review, detailing the progression from initial identification to the final inclusion of sources. It clearly delineates each phase of selection and specifies the reasons for excluding certain studies. In the initial stage, labeled ‘Identification of sources via other methods,’ 97 records were identified, consisting of 74 from websites and 23 from news organizations. Of these, 77 papers were deemed eligible for further retrieval, with 17 being excluded for not meeting the inclusion criteria. Out of the 60 remaining studies, 23 were excluded due to their length, leaving a final total of 37 reports that were thoroughly reviewed and included in the analysis. This rigorous process not only guarantees the careful selection of the pertinent literature but also enhances transparency in the methodology used for article inclusion.

In the subsequent phase, ‘Identification of sources via databases and registers,’ we initially identified 405 entries—comprising 277 documents from various databases and 128 records from registers. Prior to the screening stage, we excluded 161 papers: in total, 117 were duplicates while 44 were removed for other reasons. This reduced the pool to 244 records for screening. Of these, 37 were omitted for not meeting the inclusion criteria. We initially aimed to assess 207 papers post-screening but 120 were excluded based on the exclusion criteria. Following a thorough evaluation, we reviewed 87 records and excluded 34 articles—20 containing inaccuracies and 14 due to excessive length. Ultimately, we incorporated 53 articles from databases and registers and 37 from other sources, resulting in 90 secondary sources being included in our analysis. This systematic approach ensured a thorough and accurate selection of the pertinent literature for our research.

After pinpointing the relevant literature, a thorough examination and synthesis are carried out to address the research inquiry. This phase involves systematically extracting essential data from each chosen study, encompassing their attributes, methodologies, and key outcomes (

Cooper et al. 2018;

Atkinson and Cipriani 2018). The data extraction process adheres to a structured methodology, employing a pre-designed template to ensure consistency and precision across all analyzed studies (

Taylor et al. 2021).

The PRISMA framework serves as a solid foundation for assessing the directive’s comprehensive impacts. By integrating the literature review, comparative analysis, impact assessment, policy recommendations, and case studies, this article delivers a holistic view of the directive’s effects on European businesses (

European Commission 2022). The strength of the PRISMA method lies in its systematic approach, allowing for a nuanced understanding of the complex relationship between regulatory requirements and business operations (

Bartley 2018). Overall, PRISMA enhances this study’s goals by providing detailed, actionable insights into how the directive supports sustainable business practices within the EU (

OECD 2021).

2.2. Research Strategy and Data

To structure the literature review, the references from the article can be categorized into several groups: academic articles, regulatory documents, industry reports, and institutional publications. Each of these categories contributes to the overall understanding of the research area by providing insights from different perspectives:

Academic

Articles: Academic research in the field of business, human rights, and sustainability is well-represented. For instance, studies like those by

Bartley (

2018), which examine private authority in the global economy, and

Jamali and Karam (

2018), focusing on corporate social responsibility in developing countries, provide a strong theoretical foundation for the role of corporations in global supply chains (

Bartley 2018;

Jamali and Karam 2018). Other important contributors include

LeBaron and Lister (

2021), who explore ethical audits and the supply chains of global corporations (

LeBaron and Lister 2021);

This categorization offers a comprehensive view of the different dimensions of sustainability, corporate responsibility, and regulatory compliance in global supply chains, as reflected in the secondary sources of the article.

4. Discussion and Conclusions

This article has delved into the multifaceted impacts of the directive on European entrepreneurial activity, ecosystems, and innovation. Firstly, it highlighted the directive’s core objectives and key provisions to mitigate adverse human rights and environmental impacts across company operations and supply chains (

European Commission 2022). The analysis of compliance costs revealed significant financial and administrative burdens, particularly for SUs and SMEs, which face challenges such as increased documentation requirements, stakeholder engagement, and training needs (

OECD 2023b).

Furthermore, the directive’s influence on entrepreneurial activity was examined, showing that while it raises barriers to entry for new firms due to high compliance costs, it also opens new opportunities for businesses specializing in sustainability solutions (

International Monetary Fund 2024). For instance, companies providing sustainability consulting and compliance software have experienced increased demand, showcasing how regulatory requirements can stimulate market growth in niche sectors (

European Commission 2022).

Regarding innovation, the directive was assessed for its potential to incentivize sustainable practices and technologies. While it poses challenges by diverting resources from growth initiatives, it also encourages innovation through compliance-driven R&D (

OECD n.d.). For example, adopting blockchain technology for supply chain transparency has directly responded to compliance needs, illustrating how regulatory pressure can drive technological advancements.

The directive represents a significant step towards embedding sustainability into the core operations of European businesses. Its comprehensive scope and rigorous requirements underscore the EU’s commitment to addressing human rights and environmental issues globally (

European Commission 2022). However, the balance between sustainability and business growth remains a critical concern. The directive’s stringent compliance measures can strain SUs and SMEs, potentially stifling innovation and economic growth if not managed carefully (

OECD 2023b). Therefore, this directive’s success hinges on policymakers’ ability to implement supportive measures that mitigate its financial and administrative burdens, particularly for smaller enterprises (

OECD n.d.).

While the directive imposes new challenges, it also presents opportunities for businesses to differentiate themselves as leaders in sustainability. Companies that proactively address human rights and environmental impacts will likely stand out as industry leaders in sustainability. This proactive approach to risk management and sustainability can set SUs and SMEs apart from competitors who may be slower to adopt similar practices. Additionally, as larger companies seek to comply with their due diligence obligations, they will likely prioritize partnerships with suppliers and business associates who adhere to high sustainability standards. By fostering these partnerships, SUs and SMEs that excel in compliance can secure more business opportunities and enhance their market resilience.

Furthermore, this article contributes to a growing understanding of how the directive can spur innovation, particularly in sustainability-focused markets. The directive’s requirement for companies to adopt new compliance systems and strategies creates a demand for technological solutions, such as ESG reporting tools and supply chain management platforms. These new ventures are well-placed to meet emerging needs, fostering innovation in compliance management and sustainability solutions. Sustainable practices’ enhanced reputation and long-term profitability represent significant potential gains for companies willing to invest in them.

In summary, while the directive imposes substantial initial compliance costs, it provides long-term benefits for businesses by fostering sustainable practices and reducing operational risks. Companies that align their operations with the directive’s sustainability goals stand to gain competitive advantages, attract investment, and secure market opportunities in a rapidly changing global landscape. Additionally, the directive encourages innovation in compliance technologies, offering new ventures the chance to develop solutions that support companies in meeting regulatory requirements.

Policymakers should continuously engage with stakeholders to refine the directive and address emerging challenges. By advancing an environment of collaboration and innovation, the EU can ensure that the directive achieves its sustainability goals and supports the thriving of its entrepreneurial ecosystem (

UN Global Compact n.d.). This collaborative approach will be key to balancing regulatory compliance with economic vitality, ultimately ensuring that the directive contributes positively to environmental and business outcomes (

OECD 2023b).