1. Introduction

Uncertainty has long been a defining characteristic of financial markets, influencing decisions made by policymakers, institutional investors, and individual market participants. At its core, uncertainty refers to situations in which the probabilities of future events are either unknown or unknowable, making predictions and risk management exceedingly challenging (

Maccheroni et al., 2013). While risk can often be quantified and mitigated through established statistical techniques, uncertainty represents a more profound informational void, arising from ambiguous signals, incomplete data, or structural inefficiencies within financial systems. This distinction between risk and uncertainty is not merely academic; it has implications for asset pricing, market efficiency, and investor behavior.

In emerging economies, the challenges posed by uncertainty are particularly acute. Unlike mature markets, which are characterized by robust regulatory frameworks, high levels of transparency, and deep liquidity, emerging markets often exhibit weak corporate governance, insufficient regulatory oversight, and limited access to reliable information (

González et al., 2024;

Morck et al., 2000). These factors contribute to heightened informational opacity, making it difficult for both domestic and international investors to accurately assess the risks associated with specific assets or markets. Consequently, uncertainty in these contexts amplifies the likelihood of mispricing, inefficient resource allocation, and episodes of extreme market volatility. A critical dimension of this issue is the role of international investors, who are often key players in emerging market economies. These investors, motivated by the prospect of higher returns, frequently engage in aggressive trading strategies during periods of heightened uncertainty, rapidly moving capital across borders in response to shifting risk perceptions (

Múnera & Agudelo, 2022). Such behavior can exacerbate volatility, destabilize local financial systems, and create spillover effects that extend beyond national boundaries. Understanding how uncertainty shapes the behavior of international investors—and, in turn, the broader dynamics of emerging financial markets—is essential for developing effective policy responses and investment strategies.

This study aimed to address this gap by examining the dynamic relationships between uncertainty, global risk factors, and international investment flows in emerging stock markets. Specifically, it investigated how shifts in uncertainty, as measured by indices like the Economic Policy Uncertainty (EPU) index, influence foreign investors’ net buying behavior, market volatility, and the broader financial ecosystem. While previous research has extensively documented the role of uncertainty in asset pricing (

Hansen & Sargent, 2010;

Jiang et al., 2005;

Morgan, 2002), this study advances the literature by integrating multiple dimensions of risk and uncertainty, including global market volatility (captured by the VIX index), credit default swap (CDS) spreads, and exchange rate fluctuations.

A central focus of this research was the phenomenon of price explosiveness—periods characterized by sudden and sharp increases in asset prices. Previous studies that have examined the relationship between foreign flows and emerging market prices (price pressure) using VAR models include

Junior and Junior (

2017) and

Múnera and Agudelo (

2022). Interestingly, the findings on this topic are mixed.

Múnera and Agudelo (

2022) presented evidence consistent with price pressure in emerging markets, whereas

Ülkü (

2015) found no evidence of price pressure driven by foreign flows in European emerging markets. These studies did not explicitly test for explosivity in stock prices but instead relied on returns from aggregate market indices, attributing the negative relationship between net foreign investor sales and market returns to price pressure. In contrast, I explicitly tested for episodes of price explosiveness at the individual stock level.

These episodes, often observed in opaque markets, are particularly susceptible to the influence of uncertainty and risk. While some scholars argue that heightened uncertainty reduces the likelihood of such episodes by dampening investor confidence (

Mamman et al., 2024), others contend that uncertainty can fuel speculative bubbles, especially in contexts where traditional valuation metrics are less reliable (

Enoksen et al., 2020). By analyzing the conditions under which uncertainty contributes to price explosiveness, this paper seeks to reconcile these conflicting perspectives and provide actionable insights for market participants.

The empirical analysis was based on a proprietary dataset of ticker transaction records, encompassing over 8.6 million observations from January 2008 to November 2016. This dataset included detailed information on daily buys and sells, which was aggregated to calculate monthly net buys by foreign investors. Additionally, the 21-day rolling return volatility was computed for individual stocks to capture time-varying market dynamics. Structural vector autoregression (VAR) models were employed to estimate the impact of uncertainty and risk on key financial indicators, while variance decomposition was used to disentangle the relative contributions of different shocks to observed market fluctuations.

The results of this analysis reveal several important findings. First, positive shifts in uncertainty, as measured by the EPU index, have a significant negative impact on foreign investors’ net buying activity. This effect is more pronounced than the influence of global market volatility, underscoring the dominant role of localized uncertainty in shaping investment flows. Second, global market volatility, while less impactful on investment behavior, plays a critical role in driving CDS spreads and exchange rate movements, highlighting the interconnectedness of financial risks. Finally, episodes of price explosiveness are strongly associated with both uncertainty and global risk, suggesting that these factors jointly contribute to extreme market outcomes.

This paper contributes to the existing literature on uncertainty and risk in stock markets in several ways. First, it offers a comprehensive analysis of the dynamic relationships between international investors’ activity and various measures of risk and uncertainty, extending beyond traditional assessments of stock market risk. Second, the identification of uncertainty’s significant impact on foreigners’ net buys underscores its dominant role over global market volatility, providing valuable insights for policymakers and investors addressing the interconnected dynamics of risk and uncertainty in financial markets. Third, the variance decomposition analysis highlights the relative importance of different shocks in driving stock market fluctuations, particularly the substantial impact of global market volatility on CDS spreads, which subsequently influence exchange rate movements and stock return volatility. Finally, by estimating the start and end dates of episodes of accelerating price growth, this research reveals how uncertainty and global risk emerge as primary factors affecting opaque stock prices.

2. Results

This section presents the main results from the VAR model analysis outlined in

Section 3.2.1. The IRFs captured the short-run dynamic responses of the dependent variables to structural shocks.

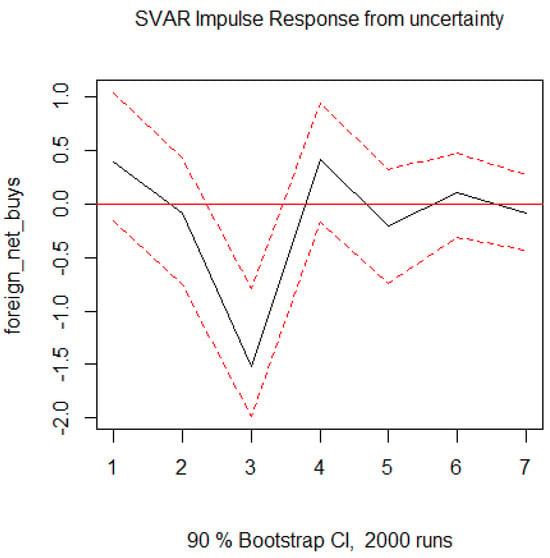

Figure 1 displays the orthogonalized responses of the aggregate foreigners’ net buys to positive shifts in the percent changes of the EPU index, using a 5-SVAR system. The significant impact on foreign activity was negative.

This result was further supported by the IRFs from a six-variable dynamic system, which included the stock return volatility and foreigners’ net buys of individual stocks, as shown in

Figure 2. The result reinforces the finding in

Agoraki et al. (

2024);

French et al. (

2024) that rising EPU only reduces the capital flows of equity funds, although they did not use transaction-level data but aggregate data at the country-level, did not analyze the foreign investors’ net buys of local equity or the interconnection and relative importance of risk and uncertainty variables, and did not include individual stock return volatilities in their analysis. The analysis used 90% confidence intervals (CIs), which were considered rigorous. For comparison,

Múnera and Agudelo (

2022) used 90% CIs,

Gomez-Gonzalez et al. (

2022) used 84%,

Gholipour et al. (

2021) used 68%, and

Chatterjee and French (

2022) did not rely on CIs. The stability conditions are verified in

Appendix B, where

Figure A15 shows that the estimated VAR model is stable, as all roots lie inside the unit circle.

Figure 3 presents the FEVD, a variance analysis or decomposition that explains variations in the response variable in terms of shocks, indicating the strength of the relationship. The FEVD corresponds to the fractions in the expression:

where is the Mean Squared Prediction Error for and . Each of these fractions represents the contribution of each unanticipated shock to the forecast error variance of variable k at horizon h. The plot illustrates the fraction on the vertical axis over on the horizontal axis, representing the proportion of the variance explained by different shocks, such as uncertainty or market volatility, at each forecast horizon.

Uncertainty played the most significant role in explaining international activity, surpassing global market volatility as measured by the VIX index. In row 2, column 2 of

Figure 3, the red areas represent the contribution of unexpected uncertainty shocks to foreign net buys, while the blue areas represent the contribution of the global market volatility during each period. Global market volatility, however, accounted for a substantial portion of the variance in CDS spreads, as shown in row 3, column 1. The blue areas in each rectangle indicate the contribution of unexpected market volatility shocks to CDS spreads, while the red areas represent the contribution of uncertainty, measured by the EPU index. This result is consistent with the IRFs from the six-variable dynamic system estimated with individual stocks (

Figure A10), where a positive shock to the global market volatility significantly increased the CDS spread. The green areas in row 1, column 2 of

Figure 3 and

Figure A4 highlight the relevance of CDS spreads for exchange rate movements, with shocks to the CDS spread leading to short-term currency depreciation, consistent with the existing literature on exchange rates (

Feng et al., 2021;

Hui & Fong, 2015). Additionally, shocks to the exchange rate are closely linked to individual stocks, as they significantly increase the stock return volatility (

Figure A6).

The analysis revealed that positive shifts in the Economic Policy Uncertainty (EPU) index significantly reduced foreign investors’ net buying activity, highlighting the stronger influence of localized uncertainty compared to global market volatility. Furthermore, exchange rate shocks substantially affected the individual stock volatility, illustrating the sensitivity of domestic markets to external economic factors. Global volatility influenced credit default swap (CDS) spreads and exchange rate movements, revealing the interconnected nature of financial risks. However, uncertainty demonstrated a more pronounced impact on international investment activity, emphasizing its central role in speculative and less transparent markets.

Below, I present the main results from the analysis of price explosiveness outlined in

Section 3.3 and

Section 3.2.2. Episodes of sudden price increases are identified and displayed in

Figure 4,

Figure 5 and

Figure 6, while the results of the probability regression models are shown in

Table 1. The dependent variable in these models was a dummy variable,

, which took the value of one if

. Given that price explosiveness is also related to monetary policy (

Jarrow & Lamichhane, 2022;

Okina et al., 2001), the dummy variables

and

took the value of one during periods of consistent decreases in U.S. and local monetary policy rates, respectively.

Global risk and uncertainty both influenced the probability of episodes of accelerating price growth in stocks, as indicated by the statistically positive parameters for the VIX index and the EPU index. Additionally, international investors contributed to explaining episodes of price explosiveness, consistent with the findings of

Griffin et al. (

2004) and

Agudelo and Múnera (

2023), who, using data at the aggregate level and returns instead of prices to explicitly test for explosivity, attributed this effect on local prices to price pressure, rather than to informed trading. In contrast, local risk—measured by stock return volatility and the CDS spread—did not appear to drive these rapid price increases. Overall, uncertainty and global risk were the primary factors affecting opaque stock prices.

4. Discussion

Ambiguity in estimating an asset’s value, arising from hard-to-observe risks, is known as uncertainty (

Jiang et al., 2005;

Kang et al., 2019;

Zhang, 2006). Unlike risk, uncertainty cannot be predicted as there is no clarity on the true probabilistic model (

Maccheroni et al., 2013), while risk refers to uncertainty with a known probability distribution (

Watkins, 1922). Uncertainty shocks caused by economic activity and policy reveal the link between different types of financial risks and financial markets (

Aggarwal & Goodell, 2014;

Awijen et al., 2023;

Cesa-Bianchi et al., 2020;

Chen & Petkova, 2012;

Gennaioli et al., 2012;

Silva et al., 2024). Incorporating uncertainty is important for asset allocation, as it is significantly correlated with illiquidity (

Kang et al., 2019) and future stock returns at the aggregate level (

Hao et al., 2024;

Jiang et al., 2005). Uncertainty in financial markets, along with the linkages and feedback effects between risks and the financial environment, is increasing. This connection has played a key role in driving various recent financial outcomes, including those related to lottery stocks (

Tao et al., 2020) and investor underreactions (

Jia et al., 2020). At the aggregate level, uncertainty and risk are related.

Sharif et al. (

2020) found that uncertainty is related to the Dow Jones volatility, and

Chatterjee and French (

2022) showed that while the VIX index did not respond to a Twitter-based market uncertainty index (TMU), a positive shock to the VIX decreased the TMU. Researchers puzzled by the mixed empirical findings regarding the relationship between firm opacity and information production in stock markets (

Crawford et al., 2012;

Derrien & Kecskes, 2013) can gain new insights from the analysis of the relation between risk and uncertainty.

The evidence showing that stock markets are susceptible to episodes of rapid price increases is extensive (

Dezhbakhsh & Demirguc-Kunt, 1990;

Diba & Grossman, 1988;

Lehnert, 2020). Risk and uncertainty are related to explosive increases in prices, although the literature is not conclusive. In cryptocurrencies,

Enoksen et al. (

2020) showed that uncertainty exhibits a positive relationship with the probability of price explosiveness, and

Jones et al. (

2012) found that opacity contributes to speculative bubbles in stock prices.

Mamman et al. (

2024) documented that the likelihood of sudden increases in oil prices decreased with heightened uncertainty. Also,

Segal et al. (

2015) argued that the risk premium is related to uncertainty.

Heightened information uncertainty contributes to the price of risk (

Hansen & Sargent, 2010) and undermines the stability of financial markets (

Liang et al., 2024). Emerging stock markets are more opaque than mature stock markets (

Morck et al., 2000), so during periods of heightened uncertainty, international investors may engage in aggressive trading (

Múnera & Agudelo, 2022) in emerging economies. Additionally, poor corporate governance and weak prosecution for insider trading contribute to informational inefficiencies (

González et al., 2024), and investments in ambiguous assets come with an extra alpha relative to a risky benchmark.

5. Conclusions

Uncertainty and global risk play pivotal roles in shaping financial markets, particularly in emerging economies characterized by informational opacity and structural inefficiencies. This study examined the dynamic relationships between international investors’ activity and measures of uncertainty and risk in an emerging market context, focusing on their influence on net foreign buys, credit default swap (CDS) spreads, exchange rates, and stock return volatility. Using a proprietary dataset of over 8.6 million ticker transaction observations, this research employed structural vector autoregression (VAR) models and variance decomposition to identify the key drivers of market fluctuations.

The findings revealed that positive shifts in uncertainty, as measured by the Economic Policy Uncertainty (EPU) index, significantly reduce foreign investors’ net buys, a pattern more pronounced than the effects of global market volatility captured by the VIX index. While global volatility is a primary driver of CDS spreads, these spreads are shown to strongly influence exchange rates, leading to short-term currency depreciation. Additionally, heightened uncertainty and global risk contribute to episodes of accelerating price growth, demonstrating their interconnected role in market instability. This paper advances the literature on financial uncertainty by emphasizing its dominant influence over global factors in driving international investment behavior and by highlighting its role in episodes of price explosiveness. The results provide actionable insights for policymakers and investors, underscoring the importance of managing localized uncertainty and global risks in opaque markets.

These findings offer valuable insights for investors and policymakers. They reveal how risk and uncertainty drive rapid price growth, particularly in opaque markets where external conditions dominate. Addressing these challenges requires stronger regulatory frameworks, improved transparency, and measures to mitigate the disruptive effects of uncertainty on financial systems.