1. Introduction

Achieving sustainability across various domains presents a significant challenge for contemporary society. Environmental sustainability is a critical aspect of the Sustainable Development Goals (SDGs) and has increasingly garnered scientific interest in recent years [

1]. Globally, nations are integrating efforts to develop sustainable industrial practices and enhance living standards, given that environmental degradation poses a substantial threat to human well-being. Effective management of carbon emissions, in particular, is vital for improving public health and advancing the SDGs [

2].

Combatting climate change is a central challenge in attaining sustainable development objectives, impacting both developing and developed nations. Recent statistics indicate that carbon dioxide (CO

2) emissions contribute approximately one-third of global greenhouse gas emissions [

3]. Remarkably, energy consumption in developed countries has resulted in a 2.5% increase in CO

2 emissions. The Paris Agreement mandates reductions in CO

2 emissions by transitioning to cleaner and more reliable energy sources, as energy plays a fundamental role in ecological sustainability and long-term development.

The global demand for energy is rising due to population growth, economic expansion, financial system changes, and rapid industrialization. Progress in the use of renewable energy is imperative to meet the SDGs. Green energy sources such as hydro, wind, and geothermal energy are essential for achieving sustainable development. Additionally, renewable energy sources offer several benefits, including widespread availability, fair energy costs, enhanced energy efficiency, resource conservation, and reduced dependence on imported energy.

Currently, fossil fuels supply a large portion of countries’ energy needs and face a high risk of depletion in the coming decades. In 2020, fossil fuels accounted for 83% of world energy consumption. These energy sources also significantly contribute to environmental degradation [

4]. As result of these factors, governments are rapidly shifting their energy policies to prioritize the use of renewable energy sources. For example, Johnstone et al. find that public policy plays a significant role in determining patent applications. They also note that different types of policy instruments are effective for different renewable energy sources [

5]. Additionally, in many studies, results indicate that increasing renewable energy consumption has an overall positive effect on economic growth, as seen in the European Union [

6] and in developing countries like Ghana [

7].

Renewable energy continues to be the main concentration of researchers. Due to their environmental sensitivity, such energy sources can serve the sustainable development of a country by preventing environmental degradation [

8]. The use of clean energy sources accelerates growth, encourages technological innovations, and supports financial development [

9]. In this context, an improved financial system could allocate funds for the renewable energy sector at a lower cost, thereby encouraging the use of clean energy sources. With financial globalization affecting the financial sector, extra funds may turn to renewable energy investments, and the development of this sector may gain momentum [

10]. In addition to these variables, some studies present findings that increases in natural resource rents and fixed capital investments positively affect renewable energy consumption [

11].

In our research, we paid special attention to how economic growth and advancements in foreign trade are recognized as significant drivers of increased demand for renewable energy through the expansion of economic activities. Grossman and Krueger [

12] elaborate on the effects of trade openness, highlighting its impact on the scale, composition, and technological aspects of production. The scale effect, in particular, suggests that trade openness can boost domestic production and economic growth, leading to higher energy demands. Empirical studies indicate that trade openness may promote the use of renewable energy [

13]. Nonetheless, the results from empirical research are often complex and inconsistent. For example, Lin et al. [

14] find that trade openness can lead to a reduction in renewable energy consumption, whereas Lu et al. [

15] identify a direct positive relationship between trade openness and renewable energy use. These differing findings underscore the need for further research to clarify the relationship between trade openness and renewable energy consumption.

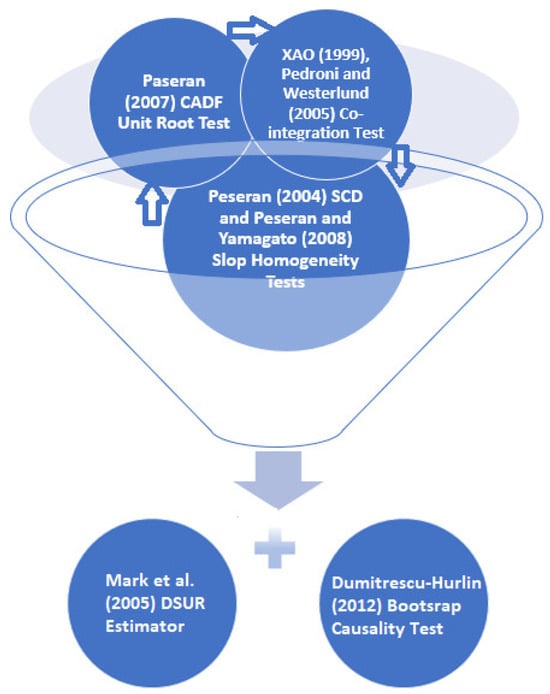

These panel studies discuss how the association between trade openness and renewable energy consumption generally benefit from panel OLS, DOLS, FMOLS, system GMM, PMG, MG, and corrected LSDVC estimators, as well as the Granger panel and Dumitrescu–Hurlin classical causality test. In empirical analyses, it is seen that dynamic SUR (DSUR) estimators and panel bootstrapping causality tests are not preferred. The most important aspect of our study that differs from the literature is the DSUR estimator, which has privileged characteristics over other techniques, and the Dumitrescu–Hurlin panel bootstrapped causality approach.

We examined the top 15 countries that consumed the most renewable energy worldwide in 2018.

Table 1 shows that from 1990 to 2018, global renewable energy use increased significantly. The best performances are China, the USA, and Germany, with values of 143.50, 103.80, and 47.33 (million tons of oil equivalent), respectively. The consumption of clean energy has remarkably increased in these economies from 1990 to 2018. In 2018, the worldwide use of clean energy was 561.30 (million tons of oil equivalent), while the total value of 15 countries was 466.07 (million tons of oil equivalent). This figure corresponds to 83% of the global total.

Table 1 also shows the total GDP (constant 2015 billions of USD) figures for the countries sampled in this study. While the total GDP value of 15 countries was 60,318 (constant 2015 billion USD) in 2018, the world’s total GDP value was 82,510 (constant 2015 billion USD). In parallel with renewable energy consumption and total GDP figures, the total foreign trade figures of 15 countries constitute an important part of the world total. Similarly, renewable energy usage in these nations increased between 1990 and 2018, and the same trend is felt in total GDP and total foreign trade. These developments provide an important motivation for our research. In this context, it also emphasizes the need for further empirical research on the connection between economic growth, foreign trade, and clean energy in these countries.

Based on the arguments mentioned earlier, this paper raises the following research questions: (1) What is the causal relationship between trade openness and renewable energy consumption (in the top renewable energy-consuming countries)? (2) How do economic growth, natural resources, capital, and financial globalization influence renewable energy consumption? (3) Does financial globalization hinder or promote renewable energy consumption? (4) What policy proposals can be developed in these countries to support the renewable energy sector?

Based on these research questions, two main hypotheses will be empirically tested using panel data techniques to provide insights into policy recommendations for supporting the renewable energy sector. The first hypothesis assumes that trade openness positively influences renewable energy consumption by facilitating the transfer of renewable energy technologies and promoting international cooperation in the energy sector. The second hypothesis assumes that economic growth, capital stock, and financial globalization positively impact renewable energy consumption, while natural resource availability may have a negative effect due to the resource curse hypothesis.

This research makes several notable contributions to the literature. First, it specifically examines the top 15 economies with the highest renewable energy consumption in 2018. Second, the study explores the trade–energy relationship by incorporating natural resources, economic growth, capital, and financial globalization as explanatory variables in the model. This comprehensive approach allows for a nuanced assessment of how these factors influence renewable energy use, enabling more informed recommendations for policymakers. Third, the research employs the dynamic Seemingly Unrelated Regression approach for empirical analysis. This method is particularly effective when cross-sectional units are interdependent and the time dimension of the panel exceeds the number of countries, providing robust estimates. Fourth, while the Dumitrescu–Hurlin panel bootstrap causality test is commonly used in empirical research [

16], its bootstrap variant is seldom applied. This study includes this advanced version of the test, adding a novel methodological perspective. Finally, the findings confirm that trade openness, economic growth, and capital investment positively impact renewable energy consumption, whereas financial globalization has a negative effect. These insights can help policymakers design more effective and sustainable renewable energy policies in the long term.

The rest of this study is presented as follows:

Section 2 discusses the literature review.

Section 3 reveals a methodological framework, an empirical model, and data.

Section 4 exhibits empirical results.

Section 5 dwells on the discussion.

Section 6 presents the conclusion, policy implications, limitations, and future research directions.

5. Discussion

The empirical analysis conducted made it possible to obtain a number of statistically significant results. First, economic growth influences renewable energy consumption. The long-run outcomes of our study indicate that a 1% increase in GDP is associated with a 0.069% increase in renewable energy consumption. In this context, Vural [

25] emphasizes that real GDP is a crucial indicator of clean energy consumption, highlighting its role as an economic driver. Similarly, Sadorsky [

69] and Rahman and Sultana [

41] found that real GDP per capita is a significant determinant of long-term energy consumption, suggesting that economic growth influences energy demand. Our results support the conservation hypothesis, which suggests that economic growth drives energy consumption [

7]. Economic growth can promote clean energy consumption by expanding the energy market; however, a balanced approach is necessary to ensure that growth does not exacerbate environmental challenges. In these situations, supporting renewable energy investments becomes crucial for managing the increased energy demand driven by economic expansion while mitigating adverse environmental impacts [

28]. Our DSUR findings are consistent with the results of Mohamed et al. [

74]. Using the ARDL model for France, they demonstrate that long-term economic growth positively influences clean energy consumption.

In contrast, our findings diverge from those of Uzar [

75], who identified an indirect linkage between economic growth and clean energy usage across 43 countries. Similarly, Shahbaz et al. [

76] suggest that economic growth may actually reduce clean energy usage, highlighting a more complex relationship than that observed in our study. In other studies, like Gyimah [

7], who examined the relationship between economic growth and clean energy use in Ghana using time-series techniques, there is no causal linkage between these variables, which also differs from our findings. These variations underscore the nuanced nature of the relationship between economic growth and clean energy consumption, suggesting that the impact of economic growth on renewable energy use can vary depending on regional, methodological, and contextual factors.

Second, trade openness positively affects renewable energy consumption. A 1% increase in trade openness leads to a 0.143% rise in renewable energy consumption. This is the strongest positive effect among the independent variables, highlighting the role of trade in facilitating the transition to renewable energy sources, possibly through technology transfer and investment (

Table 7). Our findings align with the research of Jebli and Youssef [

27], who suggested that trade liberalization fosters the growth of green energy. Similarly, Baye et al. [

13] demonstrated that trade increases green energy output in sub-Saharan Africa, reinforcing the idea that trade openness significantly influences renewable energy consumption [

24]. Omri and Nguyen [

70] argue that the movement of goods and services facilitates access to green technologies, thereby boosting the demand for renewable energy. Furthermore, trade openness is widely recognized as a key channel for the international transfer of clean technologies [

77]. This perspective underscores the importance of trade in advancing the adoption and development of green energy technologies on a global scale.

The positive link determined among trade openness and clean energy usage is similar to the findings of Vural [

25], who focused on selected Latin American countries. This study’s outcomes coincide with the results provided by Alam and Murad [

78]. On the other hand, contrary to these studies, our analysis does not match the outcomes of Baye et al. [

13] for 32 SSA regions. The aforementioned studies indicate that trade openness decreases renewable energy use.

Third, natural resources are not significant. The findings indicate no significant linkage between natural resources and clean energy use. This situation occurs despite the fact that in many of the countries analyzed, there is a risk of resource depletion that needs to transition from non-renewable to renewable energy sources, as Sadorsky points out [

79]. Another factor that can be taken into consideration is natural resource rent. Extremely high levels of these rents can potentially hinder investments in renewable energy. This is because substantial revenues from natural resources might reduce the immediate economic incentives to invest in cleaner alternatives [

32]. Additionally, Canh [

80] supports the notion that wealth, which is often linked to natural resources, can enhance the use of renewable energy. By facilitating access to capital for investments, wealth derived from natural resources can potentially promote the expansion of renewable energy usage. These perspectives highlight the complex relationship between natural resources and renewable energy, suggesting that while natural resource wealth might offer capital for investment, it can also present barriers if not managed with a focus on sustainability.

Fourth, capital positively and slightly affects renewable energy consumption. In the long run, we determined a direct association between capital and renewable energy consumption. Discussing the situation where environmental factors exceed the cost of consumption in the preference of energy sources, Damette et al. [

40] emphasize that relative capital costs and income level are critical in choosing renewable energy consumption. As a matter of fact, it is certain that directing and encouraging a significant part of capital investments in the renewable energy sector and projects will develop this sector faster [

35]. Our findings are also consistent with the results of Paramati et al. [

38]. Their study investigated how both domestic and foreign capital influence clean energy consumption in developed countries. They found that both types of capital contribute to an increase in renewable energy use. Similarly, Islam et al. [

39] reached comparable conclusions in their analysis of renewable and non-renewable energy use in Bangladesh. Our results also align with the results of Riti et al. [

81], who explored the relationship between renewable energy consumption and its determinants in sub-Saharan African countries and found that capital investment positively influences clean energy use, as identified using the Dumitrescu–Hurlin panel causality technique. Also, Rahman and Sultana [

41] observed a positive relationship between capital investment and clean energy consumption in emerging economies. These variations underscore the context-dependent nature of the relationship between capital investment and clean energy use.

Finally, we determined that financial globalization decreases the utilization of green energy. A 1% increase in financial globalization is associated with a 0.173% decrease in renewable energy consumption. This demonstrates that the share of fossil fuels in investments might be considerably higher than the share of clean energy sources [

13]. It can also be interpreted as a large part of the financial investments and capital arising from globalization flowing into the fossil fuel sector. Our finding is consistent with the results of Majeed et al. [

57], who found that economic globalization adversely affects clean energy consumption. In contrast, Koengkan et al. [

82] demonstrated a direct positive relationship between globalization and the use of clean energy in Latin American countries. Similarly, Ozcan et al. [

21] explored the linkages between globalization, human capital, and clean energy use in Turkey. Their study indicates that social, political, and economic globalization have a direct positive effect on clean energy consumption. These differing results suggest that the impact of financial globalization on renewable energy can vary significantly depending on regional and contextual factors.

6. Conclusions and Policy Recommendations

The inclusion of many of the world’s leading renewable energy-capacity economies in our analysis underscores the significance of investing in and supporting the renewable energy sector. Additionally, the focus on macroeconomic factors is crucial for developing effective policies and strategies to enhance renewable energy use and achieve sustainable energy goals.

The DSUR results confirm the first hypothesis, which assumes that trade openness positively influences renewable energy consumption. Additional literature analysis suggests that this might occur by facilitating the transfer of renewable energy technologies and promoting international cooperation in the energy sector. The second hypothesis was only partially confirmed. Economic growth and capital investment positively influence the use of green energy sources. In contrast, financial globalization appears to discourage the use of green energy. The relationship between natural resources and green energy consumption was found to be statistically insignificant. The causality analysis identifies unidirectional causal linkages from all the regressors to green energy consumption, suggesting that these factors play a significant role in shaping the use of renewable energy.

Based on the empirical findings of the study, several recommendations can be made to advance the renewable energy sector in the sampled economies. In the first place, expanding trade openness can enhance energy efficiency policies by fostering the production and adoption of renewable energy technologies and facilitating access to advanced technological products. Moreover, strengthening trade relationships with countries that excel in renewable energy can help reduce dependence on imported fossil fuels, such as oil and gas, thereby contributing to a more sustainable and self-reliant energy strategy.

In addition, the study’s results indicate that economic growth is a significant factor influencing the adoption of clean energy sources. Thus, fostering economic development can enhance environmental awareness and positively impact the use of renewable energy. Policies aimed at stimulating economic growth should, therefore, be a central component of strategies to increase renewable energy utilization. Furthermore, given that capital promotes the use of renewable energy in the long term, investments in renewable energy technologies and infrastructure are essential. Governments and financial institutions should foster favorable conditions for such investments through incentives and supportive regulatory frameworks.

As a final point, given the finding that financial globalization appears to diminish the use of green energy, as suggested by Padhan et al. [

73], globalization can enhance a country’s economic performance and influence energy consumption in diverse ways. For instance, according to the Pollution Haven Hypothesis, the impact of globalization on energy use is often mediated through direct investments. If foreign capital, channeled through multinational companies, preferentially supports traditional energy sectors rather than renewable energy, it could negatively impact the latter. To address this, it is recommended that governments refocus efforts on the renewable energy sector by implementing more effective incentives to attract foreign direct investment into green energy projects. Additionally, the empirical evidence indicates that the financial sector, which has expanded through financial globalization, has largely allocated its investments to fossil fuel-based energy production rather than renewable energy. To counter this trend, policymakers should consider strategies to encourage the financial sector to redirect its investments towards renewable energy initiatives, thereby supporting the transition to a more sustainable energy system.

We acknowledge several limitations of this study. It primarily examines total trade openness without analyzing the distinct effects of exports and imports on renewable energy consumption. Another limitation is the lack of comparative empirical findings, as economies with minimal renewable energy use were not included in the analysis. Additionally, the study does not differentiate between specific renewable energy sources, such as solar, wind, and bioenergy. Moreover, it does not provide country-specific insights, since estimation techniques like AMG and CCEMG were not employed. Addressing these limitations in future research could lead to more nuanced policy recommendations and a deeper understanding of the factors influencing renewable energy consumption.